NVIDIA Corporation: Sustaining Leadership Amid Competitive Dynamics in the AI Chip Market

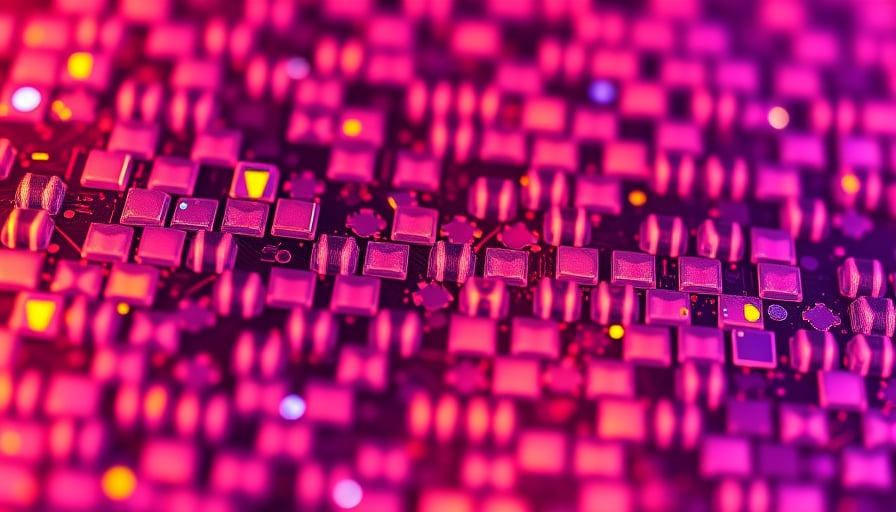

NVIDIA Corporation, a preeminent designer of graphics processing units (GPUs) and artificial intelligence (AI) accelerators, continues to command investor and analyst attention. The company’s recent communications underscore its commitment to defending its GPU leadership against emerging rivals, most notably the tensor processing units (TPUs) developed by Google. Executives have reiterated that NVIDIA’s silicon portfolio remains superior in performance, positioning the firm as a generational leader in AI hardware.

Market Sentiment and Volatility

Stock prices have exhibited volatility in the wake of reports concerning a prospective partnership between Meta Platforms and Google’s AI chips. This potential collaboration has prompted a cautious response from investors, reflecting wider apprehensions about intensified competition in the AI chip arena. The pullback in shares illustrates the sensitivity of market sentiment to strategic moves among industry titans and the perceived erosion of NVIDIA’s competitive moat.

Competitive Positioning and Technological Edge

Despite market swings, analysts consistently affirm NVIDIA’s dominant standing in the semiconductor space. The firm’s GPUs continue to support a broad spectrum of AI models across diverse computing platforms, from data centers to edge devices. This versatility, coupled with continuous performance enhancements, reinforces NVIDIA’s appeal to enterprises seeking scalable AI solutions. The company’s sustained research and development investments, along with its ecosystem of software developers and partners, further solidify its competitive advantage.

Valuation and Earnings Discipline

NVIDIA’s valuation has attracted scrutiny, with some observers questioning the alignment between its market price and earnings performance. Nevertheless, the company’s track record of robust revenue growth and profitability—bolstered by high-margin GPU sales and expanding data‑center revenue—remains a compelling factor for investors prioritizing technology leadership. The firm’s ability to translate technological superiority into financial strength supports a narrative of enduring shareholder value.

Broader Economic and Sectorial Implications

The dynamics observed in NVIDIA’s case resonate beyond the semiconductor sector. The heightened rivalry between GPU and TPU technologies exemplifies a broader trend toward vertical integration in AI infrastructure, where major cloud providers and hardware manufacturers seek to control both software and silicon. This convergence influences capital allocation decisions, R&D prioritization, and the strategic positioning of companies across the technology value chain. Moreover, the market’s reaction to potential partnerships underscores the interconnectedness of the tech ecosystem, where alliances can shift competitive balances and affect valuations across multiple sectors.

Conclusion

NVIDIA remains a focal point for investors and analysts due to its entrenched leadership in AI hardware, continuous innovation, and proven profitability. While competitive pressures from entities like Google and Meta introduce volatility, the company’s strategic positioning and technological depth continue to underpin confidence among market participants. The unfolding narrative reflects both the challenges inherent in a rapidly evolving semiconductor landscape and the enduring importance of fundamental business principles—innovation, operational excellence, and market foresight—in sustaining long‑term success.