Linde PLC: An In‑Depth Corporate Analysis

Linde PLC, a preeminent industrial gas and engineering enterprise, continues to attract the attention of equity analysts and institutional investors. Recent commentary from a spectrum of research houses offers a nuanced, cautiously optimistic perspective on the company’s trajectory, underscoring the need for a deeper examination of its operational fundamentals, regulatory landscape, and competitive positioning.

Analyst Sentiments and Price Target Divergence

The latest analyst upgrade by Seaport Global introduced a new, higher price target, reflecting confidence in Linde’s robust foothold within the materials sector. In contrast, Citigroup trimmed its forecast downward, signalling a more measured near‑term outlook despite maintaining a buy recommendation. This divergence highlights a key tension: while Linde’s long‑term fundamentals appear solid, short‑term market dynamics and valuation metrics may warrant a more conservative stance.

| Brokerage | Rating | 12‑Month Price Target | Change vs. Previous | Comments |

|---|---|---|---|---|

| Seaport Global | Buy | $115 | +$8 | Confidence in hydrogen‑related growth |

| Citigroup | Buy | $98 | –$5 | Cautious amid valuation pressure |

The price target spread of $17 underscores the importance of dissecting underlying valuation drivers—particularly the impact of recent market movements in the hydrogen sector.

Hydrogen Market Dynamics and Index Performance

The hydrogen‑focused Europe index, which includes Linde alongside peers such as ITM Power and PowerCell Sweden, reached a new yearly high in October before a brief correction. This index trajectory suggests that hydrogen‑related equities remain attractive entry points for investors seeking exposure to the energy transition. However, the correction signals that market sentiment is still sensitive to policy shifts and capital‑intensive deployment timelines.

Key takeaways:

- Policy Support: European governments continue to push for decarbonisation, offering subsidies and mandates for hydrogen infrastructure. Linde’s position in clean hydrogen production gives it a first‑mover advantage.

- Capital Expenditure: The capital intensity of hydrogen production (e.g., electrolyzers) remains a barrier to rapid scale, potentially restraining near‑term earnings.

- Competitive Landscape: While Linde benefits from a diversified portfolio, new entrants in the hydrogen market (e.g., emerging startups) could erode market share if they achieve cost efficiencies.

Business Fundamentals: Portfolio Diversification and Earnings Discipline

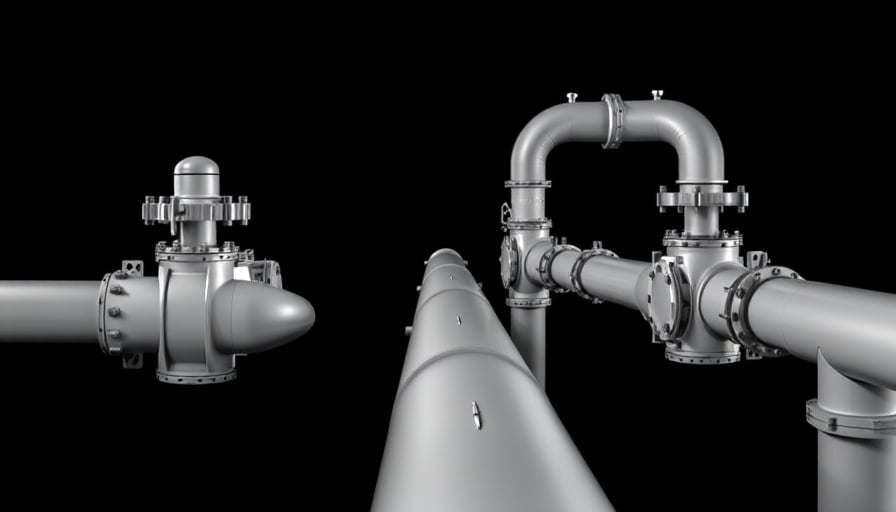

Linde’s diversified product portfolio spans clean hydrogen production, carbon capture, medical oxygen, and specialty gases for electronics. This breadth offers resilience against cyclical downturns in any single segment. Analysts consistently highlight:

- Steady Single‑Digit Organic Earnings Growth: Historically, Linde has delivered organic earnings growth between 4–7%, outpacing many peers in the industrial gas sector.

- Capital Allocation Discipline: The company’s investment in high‑margin specialty gases and carbon capture technologies signals a focus on long‑term value creation over short‑term earnings spikes.

- Robust Cash Flow Generation: Strong operating cash flow supports dividend growth and share‑buyback programs, further enhancing shareholder value.

Despite these strengths, potential risks remain:

- Regulatory Uncertainty: Changes in EU carbon pricing or hydrogen subsidies could alter the cost structure of clean hydrogen production.

- Supply Chain Vulnerabilities: Global commodity price volatility (e.g., natural gas, steel) may pressure margins, particularly in gas production units.

- Technological Disruption: Advances in alternative clean energy carriers (e.g., ammonia, green methanol) could shift demand away from traditional hydrogen markets.

Market Position and Industrial Activity Indicator

Linde’s performance is often interpreted as a barometer of industrial activity. The company’s exposure to sectors ranging from manufacturing to healthcare means that shifts in global economic conditions are reflected in its earnings. Investors monitoring Linde should therefore:

- Track macroeconomic indicators such as PMI data, steel production volumes, and healthcare demand trends.

- Assess regulatory developments in carbon capture mandates and hydrogen deployment frameworks.

- Compare valuation metrics (e.g., EV/EBITDA, P/E) against sector peers to gauge relative attractiveness.

Conclusion

While short‑term valuations may experience periodic adjustments, the prevailing consensus points to Linde’s resilience and its pivotal role in the industrial gas and engineering landscape. Investors should remain mindful of the contrasting analyst outlooks and the evolving hydrogen market dynamics, which together shape the company’s near‑term trajectory. By balancing optimism for sector growth with vigilance over regulatory and competitive risks, stakeholders can form a nuanced, data‑driven view of Linde’s future prospects.