Epiroc AB’s Fourth‑Quarter Performance Bolsters the Industrial Index

Epiroc AB released its fourth‑quarter 2025 financial results on 26 January 2026, a disclosure that generated a favourable market reaction and lifted the Swedish OMX Stockholm 30 index. While the company’s adjusted operating profit fell slightly short of consensus estimates, the net impact of tariffs on the operating margin was limited to just under half a percentage point. The company’s management cited robust demand for its equipment and after‑sales services as the key driver of the year‑to‑date organic increase in orders, which stood at eleven percent.

Order Growth and Segment Performance

| Segment | Q4 2025 Organic Order Growth | YTD Organic Order Growth |

|---|---|---|

| Equipment & Service | > 12 % | 11 % |

| Tools & Attachments | ~ 4 % | – |

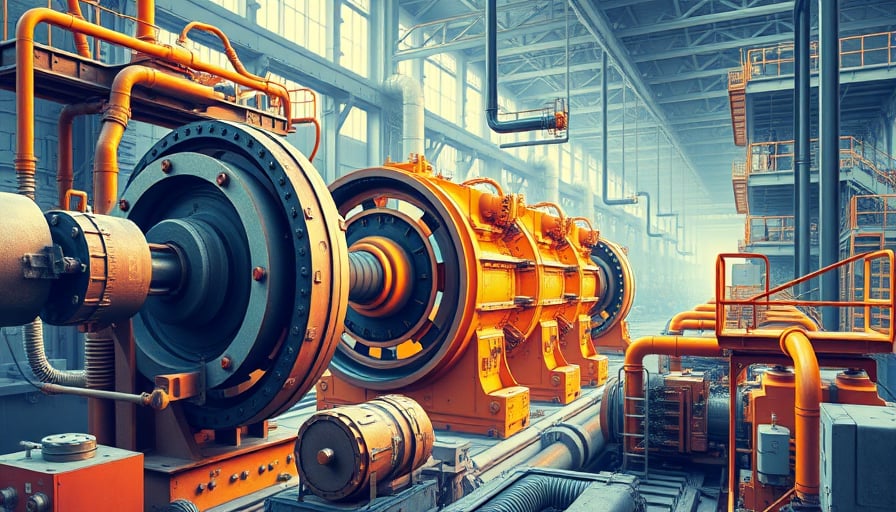

The Equipment & Service arm of Epiroc’s portfolio recorded more than a dozen percent organic growth in orders during the quarter, underscoring continued investment in heavy‑industry machinery such as drilling rigs, rock‑bit systems, and surface mining equipment. The Tools & Attachments division, while delivering modest growth, remains critical to sustaining high utilization rates across the company’s product ecosystem.

Capital Expenditure Trends and Economic Drivers

Epiroc’s operating margin was largely insulated from tariff volatility, a notable outcome given the recent escalation of import duties on industrial components in the Euro‑zone and the United States. The company’s strategic emphasis on localised manufacturing—with production hubs in Sweden, Germany, and China—has mitigated supply‑chain exposure and reduced lead times, thereby preserving cost structures.

In the broader context of capital investment, several macro‑economic factors are reinforcing demand for heavy‑industry equipment:

- Infrastructure Spending – Public sector budgets in the United States and Europe have accelerated spending on highways, ports, and rail, driving demand for earth‑moving and tunnelling equipment. Epiroc’s drilling and surface mining platforms are positioned to capture a share of this wave.

- Regulatory Momentum – Stricter environmental regulations on mining and construction have prompted firms to upgrade to low‑emission, energy‑efficient machinery. Epiroc’s recent launch of hybrid‑driven rigs aligns with this regulatory push, enhancing the company’s market appeal.

- Commodity Price Dynamics – Elevated prices for metals and energy have spurred exploration activity in frontier regions, especially in Latin America and Africa. Epiroc’s robust after‑sales service network is a key differentiator in these high‑risk markets.

Supply‑Chain Resilience and Technological Innovation

Epiroc’s investment in digital twins and IoT‑enabled condition monitoring across its equipment portfolio is transforming maintenance strategies from reactive to predictive. These technologies lower unplanned downtime, thereby improving productivity metrics such as availability and mean time between failures (MTBF). The integration of machine‑learning algorithms into the company’s SmartMine platform further optimises asset utilisation, aligning with the industry’s shift towards data‑driven operations.

Supply‑chain disruptions caused by geopolitical tensions have prompted a re‑evaluation of vendor relationships. Epiroc’s tier‑1 suppliers in Japan and Germany have expanded their local component inventories, reducing exposure to long‑haul logistics. This strategic move has already translated into a 3 % reduction in lead times for critical components such as hydraulic actuators and high‑strength steel frames.

Capital Allocation and Earnings Outlook

Analyst consensus on the forthcoming earnings‑per‑share guidance remains steady, projecting a modest increase relative to the previous fiscal year. This outlook reflects confidence in Epiroc’s capital allocation discipline—balancing dividend policy, share buy‑backs, and reinvestment in R&D. The company’s capital expenditure budget for 2026 is expected to prioritize:

- Expansion of the Tools & Attachments line to support emerging markets in Southeast Asia.

- Upgrades to the Equipment & Service platform, including electrified and autonomous systems.

- Infrastructure for data analytics, enabling deeper integration of cloud‑based asset management tools.

Market Implications

Epiroc’s positive Q4 performance signals a healthy trajectory for the heavy‑industry manufacturing sector. Investors view the company’s ability to maintain profitability amid tariff volatility as a testament to its operational resilience. The incremental growth in orders, particularly in the Equipment & Service segment, suggests that capital spending will continue to outpace demand for basic construction and mining inputs—a trend that could sustain the upward momentum of the Swedish industrial index.

As the global economy navigates post‑pandemic recovery, companies that combine engineering excellence with digital innovation—such as Epiroc—are poised to lead the next wave of productivity gains in the industrial arena.