Corporate Update: DTE Energy Co. Highlights Stability Amid Ongoing Grid Modernization

Market Performance

DTE Energy Co. recorded a modest uptick in its share price following a recent close that positioned the stock near the upper end of its yearly trading range. The company’s price‑to‑earnings ratio continues to reflect its established presence in the utilities sector, reinforcing investor confidence in its long‑term strategic focus on sustaining utility services within its operating region. No significant corporate actions or earnings announcements were disclosed in the latest update.

Portfolio Overview

DTE maintains a diversified energy portfolio that includes:

- Electricity Generation: Natural‑gas fired combined‑cycle plants, coal‑to‑gas conversion facilities, and a growing portfolio of renewable energy projects (solar, wind, and small‑scale hydro).

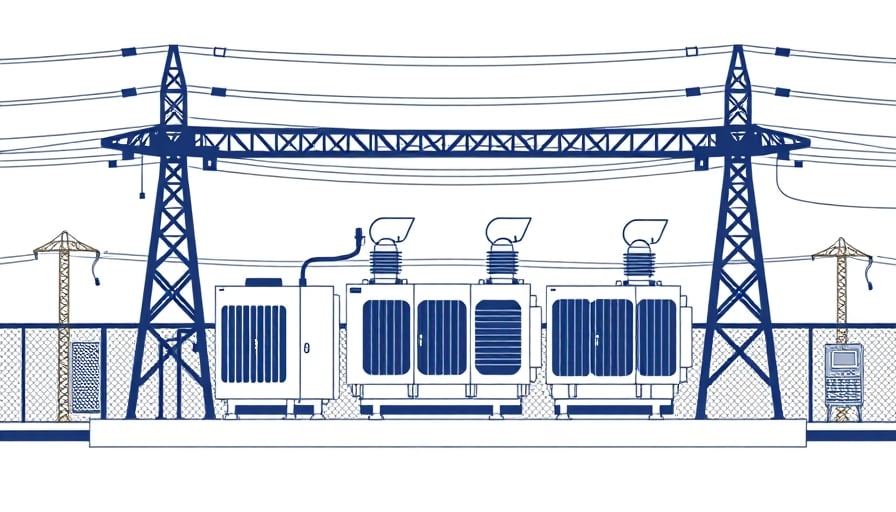

- Transmission and Distribution: A high‑voltage transmission network that interconnects southeastern Michigan’s load centers with generation assets, coupled with a distribution system designed for reliability and future smart‑grid integration.

- Gas Operations: Pipeline transport, storage, and unconventional gas development, which support the company’s integrated energy strategy.

Grid Stability and Renewable Integration Challenges

The integration of intermittent renewable resources presents several technical challenges that DTE is actively addressing:

| Challenge | Technical Implications | Mitigation Strategies |

|---|---|---|

| Voltage Regulation | Fluctuations from solar PV and wind farms can cause voltage sag or swell, impacting downstream equipment. | Deployment of static VAR compensators (SVCs) and dynamic voltage regulators across key substations. |

| Frequency Support | Reduced inertia from fossil‑fuel plants diminishes the system’s ability to counteract frequency deviations. | Implementation of battery energy storage systems (BESS) and fast‑frequency response services. |

| Demand‑Response Coordination | Peak shaving and load shifting require real‑time communication between utility and end‑users. | Integration of advanced metering infrastructure (AMI) and automated demand‑response platforms. |

Infrastructure Investment Requirements

To maintain grid reliability and support the energy transition, DTE has outlined a multi‑year capital expenditure plan that emphasizes:

- Transmission Upgrades: Expansion of 345 kV corridors to accommodate additional renewable generation and improve inter‑regional reliability.

- Distribution Modernization: Deployment of smart‑metering, voltage‑control devices, and microgrid capabilities in high‑density urban areas.

- Energy Storage: Construction of utility‑scale BESS units with a combined capacity of 200 MW/800 MWh to provide ancillary services and peak‑load support.

These investments are projected to cost approximately $4.2 billion over the next decade, with a target internal rate of return (IRR) of 8.5 % based on projected tariff increases and operational savings.

Regulatory Framework and Rate Structures

DTE operates under the oversight of the Michigan Public Service Commission (MPSC). Recent regulatory decisions have influenced its rate design:

- Capital Cost Reimbursement: The MPSC allows recovery of capital costs via a regulated rate of return (ROR) of 5.6 % for transmission assets.

- Renewable Portfolio Standards (RPS): Compliance with a 25 % renewable generation target by 2030 requires strategic investments in both generation and ancillary services.

- Time‑of‑Use (TOU) Pricing: Introduction of TOU tariffs to reflect real‑time supply constraints, encouraging load shifting and reducing the need for costly peak generation.

The utility’s rate design is structured to ensure that cost‑of‑service (CoS) recovery aligns with the economic benefits of grid modernization, while maintaining affordability for residential and commercial customers.

Economic Impacts of Utility Modernization

Consumer Costs

- Short‑Term: The rollout of AMI and smart‑metering technologies will lead to a modest increase in monthly service fees (~$2–$4) during the initial installation phase.

- Long‑Term: Enhanced grid efficiency and reduced reliance on peaking plants are expected to lower wholesale generation costs, translating into average annual savings of 1.5 % for consumers.

Regional Economic Development

- Job Creation: Capital investment in transmission and storage projects is projected to create over 1,500 skilled jobs during construction phases.

- Energy Security: Reduced transmission losses and increased renewable penetration bolster Michigan’s energy independence, enhancing the resilience of local industries.

Engineering Insights into Power System Dynamics

The transition toward a renewable‑heavy grid alters the dynamic behavior of the power system in several ways:

- Reduced System Inertia: Traditional synchronous generators provide mechanical inertia that buffers frequency deviations. As renewables increase, the inertia constant (H) decreases, necessitating fast frequency response (FFR) from storage or synthetic inertia solutions.

- Power Flow Instability: High penetrations of distributed generation (DG) can reverse power flows in distribution networks, complicating protection coordination. Adaptive protection schemes and dynamic relays are required to maintain safe operation.

- Transient Stability: Sudden loss of a renewable source can cause large swings in voltage and current. Improved forecasting and real‑time dispatch of dispatchable resources mitigate such risks.

DTE’s engineering team employs state‑of‑the‑art simulation tools, such as PSS®S/E and DIgSILENT PowerFactory, to model these phenomena and optimize system operations under various contingency scenarios.

Conclusion

DTE Energy Co. demonstrates a balanced approach to maintaining financial stability while aggressively investing in the next generation of grid infrastructure. Its strategic focus on grid reliability, renewable integration, and regulatory compliance positions the company to support Michigan’s transition to a low‑carbon economy, delivering long‑term value to shareholders, customers, and the broader community.