Market Performance Overview

During the trading session on 19 December 2025, shares of Daimler Truck Holding AG exhibited modest intraday volatility, ultimately closing within a narrow band that was only slightly elevated relative to early‑week levels. The company’s listing on the Xetra exchange continued to mirror the broader trajectory of the German equity market, which concluded the day with a marginal gain following an initially cautious opening.

Valuation Metrics

Daimler Truck’s key valuation indicator, the price‑earnings (P/E) ratio, remains comfortably below the sector average. This relative discount has reinforced market perception that the stock is reasonably valued, fostering a neutral to mildly bullish sentiment among equity investors. The P/E figure, calculated against the company’s most recent quarterly earnings, underscores the stability of its earnings base amid the current macro‑economic climate.

Correlation with Macro‑Financial Factors

The slight lift in Daimler Truck’s share price aligns with broader market optimism, partly driven by recent central‑bank announcements suggesting a potential easing of monetary policy. Anticipation of lower policy rates is expected to reduce the cost of capital for large industrial players, thereby bolstering capital expenditure (CapEx) budgets in heavy‑industry sectors.

Capital Expenditure Trends in Heavy Manufacturing

Productivity Metrics and Technological Adoption

Manufacturers in the commercial‑vehicle sector are increasingly prioritizing productivity gains through automation, digital twins, and predictive maintenance. Studies indicate that plants integrating advanced robotics and AI‑driven quality control can achieve 10‑15 % higher throughput while simultaneously reducing defect rates. Such efficiency improvements directly influence EBITDA margins, which in turn enhance investor confidence reflected in stock valuation.

Infrastructure Spending and Supply‑Chain Resilience

Recent infrastructure initiatives—particularly in rail and port logistics—have reduced transportation bottlenecks for raw materials and finished goods. These projects, coupled with a shift toward just‑in‑case inventory strategies, are mitigating supply‑chain disruptions that once plagued the industry. The resultant stability in material flows supports smoother production scheduling and reduces idle capacity.

Regulatory Landscape

Evolving emissions standards, notably the EU’s Fit for 55 package, compel manufacturers to invest in cleaner production technologies and low‑emission vehicle platforms. Capital allocation decisions now heavily weigh compliance costs against long‑term market access, especially in key export regions such as North America and Asia‑Pacific where stringent standards are adopted.

Engineering Insights into Industrial Systems

Process Optimization in Heavy‑Duty Vehicle Production

- CNC Machining and Additive Manufacturing – Integration of high‑precision CNC tools and metal‑inkjet additive processes has shortened cycle times for critical components, such as axles and chassis frames.

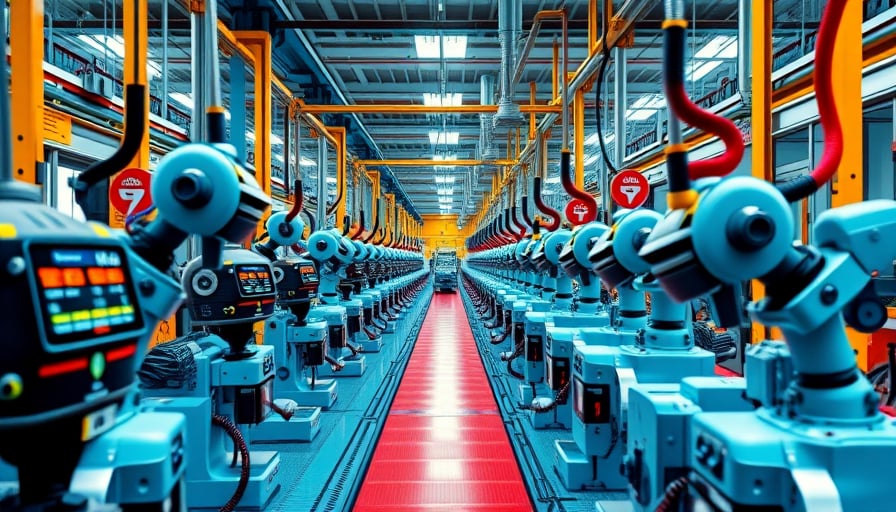

- Robotic Assembly Lines – Collaborative robots (cobots) now perform tasks ranging from torque‑control of wheel assemblies to automated paint‑application, enhancing repeatability and reducing human error.

- Digital Twin Modeling – Real‑time simulation of manufacturing workflows allows engineers to detect bottlenecks and forecast production outcomes under varying demand scenarios.

These technologies collectively contribute to a reduction in scrap rates and a lower labor‑cost intensity per unit, directly translating into improved margin profiles.

Impact on Market Dynamics

The adoption of such systems signals a shift toward capital‑intensive, technology‑driven manufacturing paradigms. Firms that successfully deploy these innovations can secure a competitive edge through cost leadership and faster time‑to‑market. Consequently, investors view these companies as better positioned to navigate cyclical downturns, reinforcing the attractive valuation profile observed for Daimler Truck.

Conclusion

The modest performance of Daimler Truck Holding AG’s shares on 19 December 2025 reflects a market that is cautiously optimistic about the company’s valuation and the broader industrial environment. Technological advancements in manufacturing, combined with favorable capital‑market conditions and evolving regulatory frameworks, are shaping a landscape where productivity and innovation dictate competitive advantage. As infrastructure spending continues to strengthen supply‑chain resilience, firms that effectively allocate CapEx toward advanced production systems are poised to reap sustained profitability in the coming years.