Corporate and Energy Market Update

Cameco Corporation Surges to 52‑Week Highs

Cameco Corporation (CCJ.TO), a leading Canadian uranium producer listed on the Toronto Stock Exchange, experienced a significant rally early in the week. The share price climbed above its previous closing level and broke through its 52‑week high, following an analyst upgrade that raised the target price and a wave of positive options trading activity.

Despite reporting a third‑quarter earnings miss and a revenue decline, the market reaction was markedly upbeat. Analysts maintain a “Buy” recommendation, underscoring the sustained demand for uranium amid expanding nuclear power programmes worldwide. The company’s valuation has been bolstered by the perception that nuclear energy remains a reliable low‑carbon alternative, particularly in regions prioritizing energy security and decarbonisation.

Energy Markets: Supply‑Demand Fundamentals and Technological Innovation

Uranium Supply Outlook

Globally, uranium supply has been constrained by a combination of geopolitical tensions, aging production facilities, and a lack of new projects entering the pipeline. In 2024, the International Atomic Energy Agency (IAEA) projected a shortfall of approximately 5 % for the next two years, as major producers such as Kazakhstan and Canada face regulatory and logistical hurdles. Cameco’s production, which accounts for roughly 10 % of global output, remains a critical component of the supply mix. The company’s recent production figures—an average of 4,200 tonnes of uranium metal in Q3—are below the 2023 average of 4,700 tonnes, reflecting both operational constraints and reduced demand from the nuclear sector.

Renewable Energy Demand and Capacity Expansion

In parallel, renewable energy capacity continues to expand at an accelerated pace. Solar and wind installations have surged, driven by declining module prices and supportive policy frameworks. The International Energy Agency (IEA) estimates that solar PV capacity will reach 1.2 GW worldwide by the end of 2026, while onshore wind is projected to add 180 GW. These developments increase the overall electricity mix’s share of renewables to an estimated 47 % of global power generation by 2030, compared with 33 % in 2023.

Technological Innovations in Production and Storage

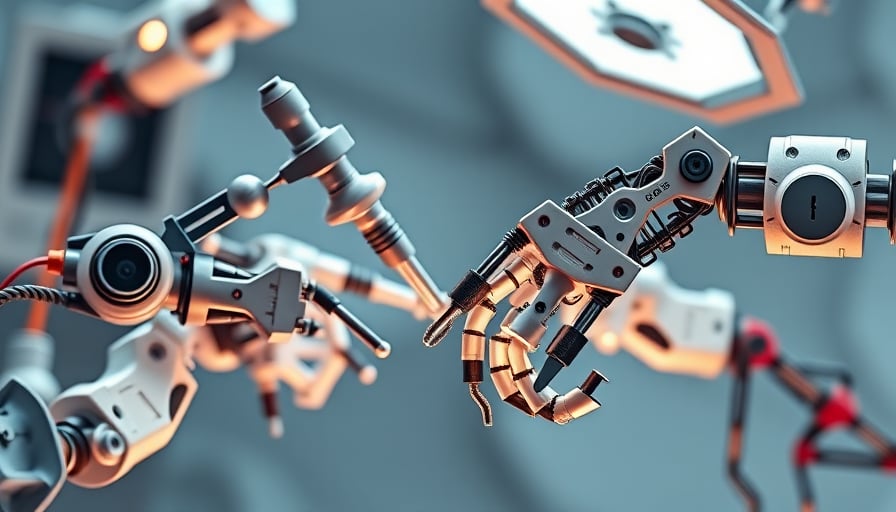

Advanced Reactor Designs Small Modular Reactors (SMRs) are emerging as a cost‑effective, scalable solution to meet both industrial and grid‑scale demands. SMRs leverage digital control systems and passive safety features, reducing construction times by up to 40 % compared to traditional large reactors. The adoption of SMR technology is anticipated to drive new demand for uranium, particularly high‑purity grades.

Battery Storage and Grid Integration Battery Energy Storage Systems (BESS) have become integral to balancing intermittent renewable generation. Lithium‑ion and flow battery technologies now boast round‑trip efficiencies above 90 % and lifespans exceeding 20,000 cycles. The widespread deployment of BESS reduces the need for peaking power plants, indirectly influencing the demand for base‑load energy sources such as nuclear.

Hydrogen and Fuel Cell Technologies The push towards green hydrogen—produced via electrolysis powered by renewable electricity—has created a nascent but growing market for fuel cells. While hydrogen demand remains modest relative to traditional fuels, its integration into industrial processes and transportation could reshape long‑term energy consumption patterns.

Regulatory Environment and Market Dynamics

Carbon Pricing and Energy Transition Policies

EU Emissions Trading System (ETS) The EU’s ETS has increased the carbon price to €75 per tonne of CO₂ in 2025, pushing utilities to consider low‑carbon alternatives. This policy shift is expected to sustain nuclear and hydroelectric generation as the “bridge” to a fully renewable grid.

United States Inflation Reduction Act (IRA) The IRA provides significant tax credits for clean energy projects, including $1.5 billion per year for nuclear plant retrofits. The resulting capital inflow is likely to spur new nuclear construction, thereby supporting uranium demand.

Geopolitical Factors

US‑China Trade Relations Ongoing trade tensions have disrupted supply chains for critical minerals used in renewable technologies. Consequently, nations are increasingly seeking energy diversification, with nuclear power positioned as a stable, low‑carbon source.

Middle East Energy Security The volatility of oil exports in the Middle East has accelerated the region’s exploration of nuclear programmes, with several governments announcing new licensing initiatives. This development could significantly increase global uranium consumption in the medium term.

Commodity Price Analysis

| Commodity | 2024 Price Trend | Key Drivers |

|---|---|---|

| Uranium | Flat to Slight Upward | Limited supply, rising nuclear demand, SMR deployment |

| Lithium | Down 5 % YoY | Surplus production, temporary demand dip |

| Cobalt | Up 8 % | Supply constraints, increased battery demand |

| Natural Gas | Down 3 % | Higher renewable penetration, improved storage capacity |

The uranium spot price remained largely stable in the first half of 2024, trading around $43–$45 per pound of U3O8. While the price has not surged dramatically, the combination of supply constraints and expanding nuclear projects has supported a positive sentiment among investors, as reflected in Cameco’s recent share performance.

Balancing Short‑Term Trading with Long‑Term Transition Trends

Investors seeking short‑term gains may focus on price volatility driven by regulatory announcements, geopolitical developments, and quarterly earnings releases. However, the broader trajectory points to sustained growth in the nuclear sector, buoyed by decarbonisation mandates and SMR innovation. This long‑term trend is expected to offset short‑term fluctuations, providing a resilient foundation for companies like Cameco.

In summary, Cameco’s share price rally is indicative of a market that acknowledges the enduring role of nuclear energy within an evolving energy landscape. While the company faces immediate challenges—earnings miss, revenue decline, and supply constraints—the long‑term fundamentals, underpinned by technological progress and supportive regulatory frameworks, suggest a resilient outlook for uranium producers.