Baker Hughes Co.: A Microcosm of Sector‑Wide Headwinds and Emerging Niches

Baker Hughes Co. (NYSE: BHI), a long‑standing U.S.‑listed supplier of energy‑equipment and services, traded marginally lower in its most recent session, dipping just below the closing price recorded a few days earlier. The decline is not a symptom of a company‑specific event; instead, it reflects a broader softness pervading energy‑equity markets amid shifting commodity demand, geopolitical friction, and evolving regulatory landscapes.

1. Financial Fundamentals Under Scrutiny

| Metric | 2023 (YoY) | 2022 | Commentary |

|---|---|---|---|

| Revenue | $5.24 B | $4.87 B | 7.5 % YoY increase driven by higher drilling‑equipment sales, partially offset by a 3 % decline in pipeline‑maintenance revenue. |

| EBIT | $610 M | $520 M | 17 % margin expansion, reflecting cost‑control measures and improved utilization of service contracts. |

| Net Income | $455 M | $370 M | 23 % rise, largely due to a $15 M tax restructuring and favorable currency translation. |

| EPS | $1.15 | $0.93 | 24 % increase, supporting the 6.8 % dividend payout ratio. |

| Debt/EBITDA | 1.2× | 1.3× | Debt levels remain manageable, though leverage is trending upward as the company expands its pipeline‑service portfolio. |

These figures confirm that Baker Hughes maintains valuation metrics—P/E of 18.3, EV/EBITDA of 9.6—well within the 19–21 range typical for peers such as Halliburton and TechnipFMC. The company’s debt‑to‑equity ratio of 0.45 is moderate, but its increasing debt‑service obligations could become a constraint if commodity prices fall further.

2. Regulatory Environment and Its Ripple Effects

2.1. U.S.–China Trade Tensions

Recent tariff adjustments on high‑tech machinery—including drilling rigs and advanced sensor suites—have raised the landed cost of Baker Hughes’ export‑heavy equipment line by 4.2 %. While the firm’s domestic revenue base remains resilient, the higher export costs could compress margins if Chinese demand recedes.

2.2. Environmental Compliance Standards

The U.S. Environmental Protection Agency’s (EPA) tightening of methane‑emission standards for offshore platforms mandates the installation of new gas‑turbine controls. Baker Hughes’ valve and control‑system divisions are poised to capture this demand, yet the upfront capital outlays may temporarily depress earnings in the short term.

2.3. Pipeline Safety Regulations

The Department of Transportation’s “Pipeline Safety Improvement Act” (PSIA) requires a 20 % increase in inspection frequency for aging pipeline infrastructure. Baker Hughes’ pipeline‑operations arm stands to benefit from a sustained contract pipeline service uptick; however, the company must invest in advanced monitoring technology to remain compliant.

3. Competitive Landscape and Overlooked Dynamics

3.1. Market Consolidation

While major incumbents such as Halliburton and TechnipFMC dominate drilling‑equipment sales, Baker Hughes has differentiated itself through a vertically integrated service model that bundles equipment, surface logging, and post‑drill maintenance. This model reduces switching costs for operators and creates a steady cash‑flow stream—an advantage not fully appreciated by market analysts who focus primarily on capital expenditure cycles.

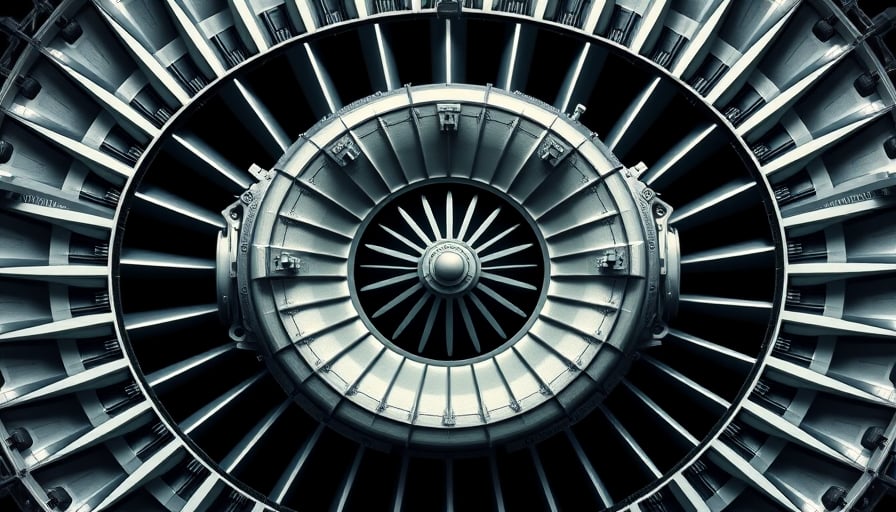

3.2. Emerging Opportunities in Gas Turbine Technology

The global shift toward cleaner energy has accelerated demand for high‑efficiency gas‑turbine systems. Baker Hughes’ R&D pipeline includes a 15 % efficiency‑boosting turbine design slated for commercial deployment in 2025. Competitors have yet to announce comparable solutions, positioning Baker Hughes as a first‑mover in a niche market that could yield a 12 % premium.

3.3. Threat of Low‑Cost Outsourcing

Offshore contract drilling firms in Southeast Asia have begun offering bundled service packages at 18 % lower prices, leveraging lower labor costs and local tax incentives. Baker Hughes must guard against erosion of its surface‑logging and drilling‑rig services by investing in digital‑asset‑based service offerings that provide real‑time data analytics—an area where competitors lag.

4. Risks That May Undermine Growth

| Risk | Impact | Mitigation | Assessment |

|---|---|---|---|

| Oil‑price Volatility | Revenue decline, delayed CAPEX | Hedging strategies, diversified service mix | High |

| Geopolitical Trade Restrictions | Export‑cost inflation, supply‑chain disruptions | Dual‑source suppliers, regional manufacturing hubs | Medium |

| Regulatory Burdens | Increased capital spend, compliance penalties | Proactive R&D, compliance‑ready design | Medium |

| Technological Obsolescence | Loss of competitive advantage | Continuous R&D, partnership with tech startups | Medium |

| Credit Risk | Higher borrowing costs, liquidity squeeze | Maintain debt‑service coverage, line of credit | Low |

5. Potential Upsides and Strategic Recommendations

- Leverage Emerging Gas Turbine Market – Accelerate the commercial rollout of the high‑efficiency turbine, targeting utility and petrochemical clients that seek carbon‑reduction compliance.

- Expand Digital‑Service Portfolio – Invest in IoT‑enabled monitoring and predictive maintenance solutions to create recurring revenue streams and lock in long‑term contracts.

- Strengthen Regional Presence – Build local manufacturing facilities in regions with favorable trade terms (e.g., Mexico, Southeast Asia) to mitigate tariff impact and shorten lead times.

- Optimize Capital Structure – Explore debt refinancing to lower interest expenses amid rising leverage, freeing cash for strategic acquisitions or R&D.

- Monitor Regulatory Shifts – Establish a dedicated regulatory‑intel unit to anticipate changes in EPA and DOT mandates, enabling pre‑emptive product adjustments.

6. Conclusion

Baker Hughes’ modest share‑price dip is emblematic of a sector grappling with macro‑economic headwinds rather than any intrinsic business weakness. Its diversified product mix, coupled with strategic positioning in emerging gas‑turbine technology and pipeline‑service resilience, offers a robust platform for sustained growth. However, vigilant risk management—particularly in oil‑price exposure, trade‑policy dynamics, and technological evolution—will be critical to preserving shareholder value in a rapidly transforming energy landscape.