Corporate Developments at Grab Holdings Ltd.

Grab Holdings Ltd. has recently undertaken two significant strategic moves that underscore its ambition to deepen its footprint in the robotics, artificial intelligence (AI), and regional e‑commerce landscapes. The first move involves the acquisition of the Chinese robotics startup Infermove, while the second concerns a stalled multibillion‑dollar acquisition of Indonesia’s GoTo Group. The implications of these transactions for Grab’s competitive positioning and broader industry trends are examined below.

Acquisition of Infermove: Strengthening Automated Delivery

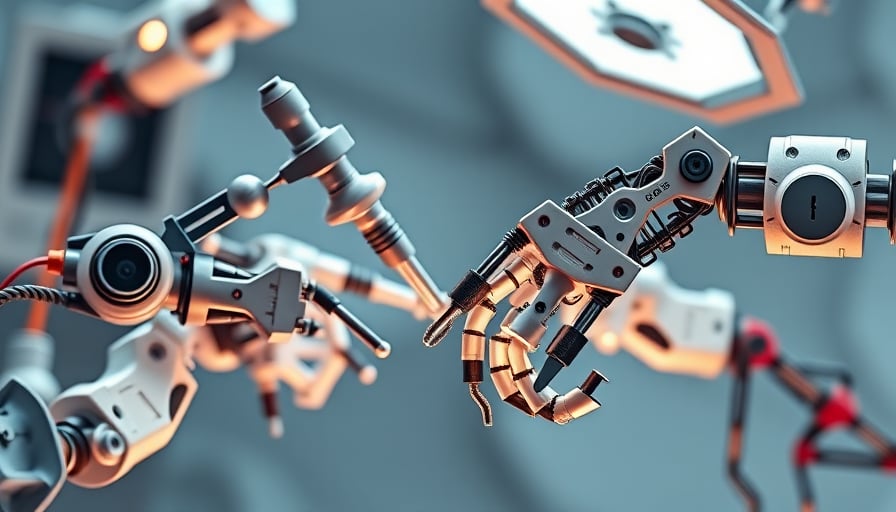

Grab’s purchase of Infermove marks a decisive step toward integrating cutting‑edge robotics and AI into its logistics stack. Infermove’s proprietary solutions for autonomous navigation and task automation are designed to optimize the early and final legs of delivery operations—stages that traditionally incur high labor costs and operational complexity.

From an operational standpoint, the integration of Infermove’s technology promises to:

| Benefit | Description |

|---|---|

| Cost Efficiency | Automated pick‑up and drop‑off reduce human labor requirements, lowering per‑delivery expenses. |

| Scalability | Robots can be deployed rapidly across multiple hubs, enabling Grab to expand service coverage without proportional increases in staffing. |

| Predictive Analytics | AI‑driven routing and demand forecasting can improve delivery times and reduce vehicle idle periods. |

The acquisition also signals Grab’s intent to diversify its revenue streams beyond ride‑hailing and food delivery. By embedding robotics into its supply chain, Grab is positioning itself as a full‑service logistics provider, a trend that is gaining traction among tech‑centric firms in Southeast Asia and beyond.

Stalled Acquisition of GoTo Group

In a parallel development, Grab’s proposed purchase of Indonesia’s GoTo Group—an integrated e‑commerce and fintech conglomerate—has encountered regulatory and valuation headwinds. State‑backed stakeholders, notably Indonesian mobile carrier Telkomsel, have expressed reluctance to relinquish a minority stake in GoTo at the proposed valuation. This hesitation has delayed the transaction’s completion, creating uncertainty for both parties.

The GoTo deal was intended to:

| Objective | Impact on Grab |

|---|---|

| Market Consolidation | Combining Grab’s ride‑hailing and delivery platforms with GoTo’s e‑commerce and digital payments would create a unified ecosystem for consumers. |

| Capital Efficiency | A merged entity could leverage shared infrastructure and cross‑sell services, potentially generating synergies worth billions of dollars. |

| Competitive Edge | The acquisition would preempt rivals such as Gojek’s continued expansion and could counterbalance the influence of global players like Amazon and Alibaba in the region. |

The current impasse raises concerns about the feasibility of achieving the envisioned scale and integration benefits. Moreover, it highlights the complexities of cross‑border mergers in markets where state entities retain significant influence over key infrastructure providers.

Market and Economic Context

Both transactions illustrate broader economic dynamics influencing the region’s digital economy:

- Regulatory Environment: Southeast Asian regulators are increasingly scrutinizing cross‑border acquisitions, especially in sectors deemed strategically important. The Telkomsel resistance reflects a cautious approach to foreign ownership that balances economic growth with national interests.

- Capital Flow Volatility: Global supply‑chain uncertainties and fluctuating commodity prices affect valuation expectations, leading to more conservative pricing negotiations for large deals.

- Innovation Acceleration: Rapid advancements in AI and robotics are reshaping logistics, prompting incumbents to acquire specialized startups to stay competitive.

- Consumer Behavior Shifts: The pandemic has accelerated demand for contactless delivery and digital payments, amplifying the strategic importance of integrated platforms like GoTo.

Analyst Outlook

Despite the obstacles, analysts maintain a cautiously optimistic view of Grab’s strategic trajectory. The company’s proactive investment in robotics signals a commitment to operational excellence, while its pursuit of the GoTo acquisition demonstrates ambition to become a one‑stop digital ecosystem. However, the current delay in the GoTo deal and the company’s share price lag relative to broader market movements suggest that investors are weighing the risks of regulatory entanglements and integration complexities.

Conclusion

Grab Holdings Ltd.’s dual initiatives—acquiring Infermove to embed AI‑powered robotics into its logistics, and attempting to acquire GoTo Group amid regulatory hurdles—highlight a multifaceted strategy aimed at deepening service diversification and achieving regional dominance. These moves reflect broader industry trends of technology integration, cross‑sector consolidation, and the need for agile adaptation to evolving regulatory landscapes. The outcome of the GoTo negotiation will be a key barometer for Grab’s ability to navigate state‑backed ownership structures while maintaining momentum in its expansion plans.