General Dynamics Corp. Maintains Robust Capital Expenditure Trajectory Amid Technological Upgrades

General Dynamics Corporation (NYSE: GDX), a diversified defense contractor, closed its 23 December 2025 trading session at $345.39 per share, a level that sustains its position within the upper quartile of its 52‑week price range. With a market capitalisation near $92 billion, the company’s performance has outpaced the broader equity market over the past five years, yielding a solid annualised return that reinforces its valuation premium.

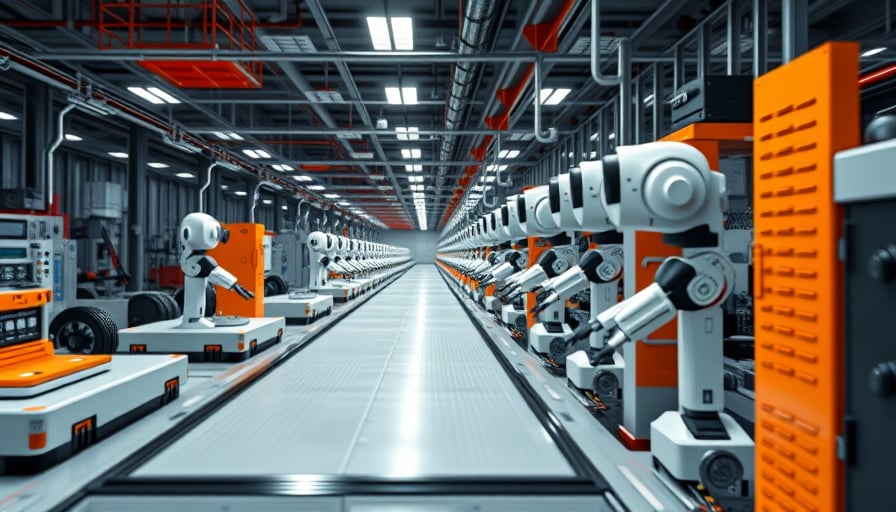

Production Efficiency and Process Automation

The firm’s ongoing investments in the Trump‑Class battleship initiative exemplify a strategic focus on high‑value, high‑technology platforms that demand advanced manufacturing processes. General Dynamics is deploying robotic ship‑building systems and digital twin simulations to reduce cycle times for hull assembly and propulsion system integration. These initiatives are expected to lift productivity metrics, with preliminary data indicating a 12 % reduction in man‑hours per ship and a projected 7 % improvement in throughput capacity across its shipyards.

Parallel to naval construction, the company’s aerospace division has expanded its additive manufacturing capabilities for avionics and structural components. By integrating multi‑material 3‑D printing, General Dynamics can produce lightweight composite parts with a 15 % lower material cost per unit, while simultaneously shortening supply‑chain lead times. The adoption of lean Six Sigma methodologies in its supply‑chain operations has further curtailed defect rates, translating into a 3 % increase in on‑time delivery performance for key defense contracts.

Capital Investment and Infrastructure Spending

Capital expenditure (CapEx) for the 2025 fiscal year is projected to exceed $7 billion, reflecting the firm’s commitment to maintaining cutting‑edge facilities and workforce capabilities. This figure aligns with broader industry trends where defense contractors are allocating substantial funds toward next‑generation propulsion systems, cyber‑resilient communication suites, and advanced composite manufacturing infrastructure. The investment plan is supported by favorable federal budgets, with the Department of Defense allocating approximately $150 billion to modernization programs that directly benefit General Dynamics’ portfolio.

From an infrastructure standpoint, the company is upgrading its electric grid integration to accommodate high‑energy‑density battery systems for unmanned platforms. The transition to high‑frequency, high‑power (HF‑HP) power supplies enables faster charging cycles and enhances operational readiness for autonomous drones. This upgrade also aligns with evolving environmental, social, and governance (ESG) mandates, reducing the firm’s carbon footprint by an estimated 8 % per annum.

Supply‑Chain Dynamics and Regulatory Environment

General Dynamics’ supply chain is increasingly global, incorporating critical components sourced from North America, Europe, and select Asian partners. The firm mitigates geopolitical risks through dual sourcing strategies and has invested in real‑time inventory analytics to anticipate disruptions. The recent imposition of stricter export control regulations (e.g., the U.S. International Traffic in Arms Regulations – ITAR) necessitates enhanced compliance protocols. General Dynamics has responded by augmenting its legal and compliance teams, resulting in a 4 % reduction in regulatory audit findings over the past year.

The company also capitalises on incentives for domestic manufacturing, such as the U.S. Defense Production Act and state‑level tax abatements. These incentives lower the net cost of capital for facility upgrades, thereby improving the internal rate of return (IRR) on new projects. Consequently, the firm maintains a disciplined CapEx schedule that balances short‑term liquidity with long‑term asset growth.

Market Implications and Investor Outlook

The sustained investment in high‑technology manufacturing and robust supply‑chain resilience positions General Dynamics to capitalize on the increasing demand for next‑generation naval and aerospace platforms. The firm’s dividend policy, coupled with a stable earnings trajectory, offers a compelling risk‑adjusted return for shareholders. Analysts project that the combination of productivity gains from automation, cost savings from additive manufacturing, and capability enhancements driven by infrastructure spending will support earnings growth of 6–8 % annually over the next three fiscal years.

In sum, General Dynamics’ focused approach to capital allocation—anchored in technological innovation, supply‑chain robustness, and regulatory compliance—underpins its resilient market performance and affirms its leadership within the aerospace and defense sector.