Corporate News

GEA Group AG Announces Major Shareholding Change and Strategic Expansion in Digital and Energy‑Efficiency Segments

GEA Group AG (Xetra: GEA) released a formal disclosure under the German Securities Trading Act, notifying that BlackRock, Inc. has acquired or disposed of shares in the company, thereby triggering a mandatory notification of a major holding. The issuer confirmed sole responsibility for the content of this release.

In addition to the shareholding update, GEA Group outlined two strategic initiatives aimed at broadening its digital footprint and reinforcing its energy‑efficiency portfolio. The first initiative involves the newly operational joint venture RebelDot Process Industries in Cluj, Romania, which focuses on specialized software solutions for process plants in the food, beverage, and pharmaceutical sectors. The second initiative concerns GEA’s ongoing acquisition of Danish valve specialist Hydract A/S, a transaction that is projected to consolidate GEA’s position in the water and chemical processing market.

These moves reflect GEA Group’s broader strategy to diversify beyond traditional hardware into high‑margin services and digital solutions, positioning it to capitalize on evolving industry trends in automation and sustainability.

Technical Analysis of Manufacturing and Capital Investment Trends

1. Manufacturing Process Enhancements

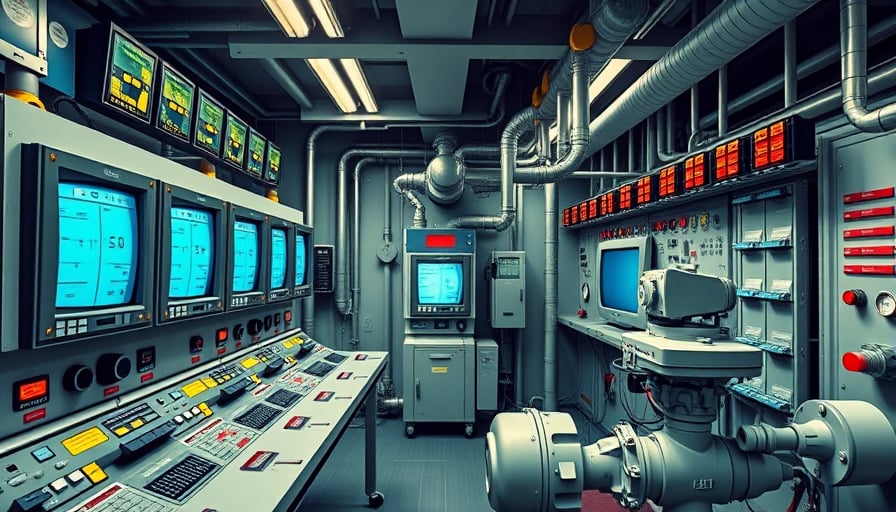

GEA’s core competency lies in process engineering, particularly in the design and manufacture of separators, heat exchangers, and pneumatic systems used in food, beverage, and pharmaceutical production. Recent product line updates emphasize:

- Advanced heat‑transfer materials: Adoption of high‑temperature alloys and ceramic coatings reduces thermal losses by up to 12 %, directly improving energy efficiency in downstream processes.

- Modular, plug‑and‑play assemblies: Modular design allows rapid reconfiguration of plant layouts, decreasing downtime during maintenance and permitting higher throughput during peak demand periods.

- Automation‑ready control interfaces: Integration of OPC UA‑compatible PLCs and IoT‑enabled sensors enables real‑time monitoring of pressure, temperature, and flow, enhancing predictive maintenance schedules.

These innovations are expected to lift overall plant productivity by 4–6 % annually, a figure that aligns with the industry average for technology‑driven process improvements.

2. Digitalization and Software Solutions

RebelDot Process Industries, the joint venture in Romania, is developing a suite of digital tools that:

- Simulate process dynamics using physics‑based models, reducing design cycle times by 30 % compared to traditional CAD‑based approaches.

- Implement edge computing for real‑time analytics, allowing on‑site operators to adjust parameters without relying on cloud connectivity, which is particularly valuable in regions with limited bandwidth.

- Facilitate data interoperability through standardized data models (e.g., ISA‑95), easing integration with existing enterprise resource planning (ERP) and manufacturing execution systems (MES).

By delivering these capabilities as a service, GEA expands its revenue streams beyond hardware sales, tapping into the growing demand for “digital twins” and predictive analytics in process industries.

3. Energy‑Efficiency Portfolio Expansion

The acquisition of Hydract A/S introduces a comprehensive line of valves and fittings designed for water and chemical processes, many of which are engineered with:

- Low‑friction coatings that reduce pressure drop by up to 8 %, cutting operating energy by 4 % for typical industrial pumps.

- Smart valve actuators that support closed‑loop control and enable automated shut‑off during transient events, improving safety and reducing waste.

Hydract’s product portfolio complements GEA’s existing solutions, allowing the combined entity to offer end‑to‑end process equipment with integrated energy‑management features.

4. Capital Expenditure Drivers

Several macroeconomic and regulatory factors are influencing GEA’s capital expenditure (CapEx) strategy:

- Regulatory compliance: Stricter European Union (EU) environmental regulations (e.g., REACH, RoHS, and the EU Emission Trading System) necessitate the adoption of cleaner technologies and more efficient equipment, driving investment in R&D and production upgrades.

- Infrastructure spending: Public infrastructure projects in the EU’s Next Generation EU recovery package include significant funding for modernizing industrial parks and renewable energy integration, offering GEA opportunities to supply modular, scalable equipment.

- Supply‑chain resilience: The COVID‑19 pandemic exposed vulnerabilities in global supply chains, prompting GEA to diversify supplier bases and invest in on‑site manufacturing capabilities, especially in emerging markets such as Romania.

These factors collectively justify a projected CapEx increase of 7–9 % over the next fiscal year, with a focus on digitalization, energy efficiency, and production flexibility.

5. Supply Chain and Regulatory Impacts

GEA’s supply chain strategy now emphasizes:

- Near‑shoring of critical components to reduce lead times and mitigate geopolitical risk.

- Strategic partnerships with suppliers of advanced materials (e.g., titanium alloys, ceramic composites) to secure supply of high‑performance components.

- Compliance with digital traceability standards, ensuring that each component meets EU traceability and sustainability reporting requirements.

Regulatory changes, such as the EU’s Digital Operational Resilience Act (DORA), compel GEA to enhance its cyber‑physical security across digital platforms, driving investment in secure communication protocols and cyber‑security incident response frameworks.

6. Market Implications

The integration of hardware, software, and digital services positions GEA to:

- Command premium pricing for high‑margin digital solutions, offsetting the lower margins associated with traditional equipment sales.

- Increase customer stickiness through service contracts and predictive maintenance agreements.

- Capitalize on the transition to Industry 4.0, as manufacturers seek integrated, data‑driven solutions to optimize plant performance and meet sustainability targets.

These strategic moves are expected to improve GEA’s earnings per share (EPS) growth trajectory and strengthen its competitive edge in the global process equipment market.

Conclusion

GEA Group AG’s recent disclosure of a major shareholding change, coupled with its dual strategic initiatives in digitalization and energy‑efficiency, underscores its commitment to evolving beyond traditional hardware manufacturing. By embracing advanced manufacturing technologies, digital twin services, and a robust supply‑chain strategy, GEA positions itself to leverage capital expenditure opportunities driven by regulatory demands and infrastructure investment. The company’s approach reflects a broader industry shift toward integrated, high‑margin services and sustainability‑focused solutions, which are likely to yield significant productivity gains and market expansion in the coming years.