Corporate Update: GE Vernova Inc. Strengthens Global Presence in Gas‑Turbine Technology

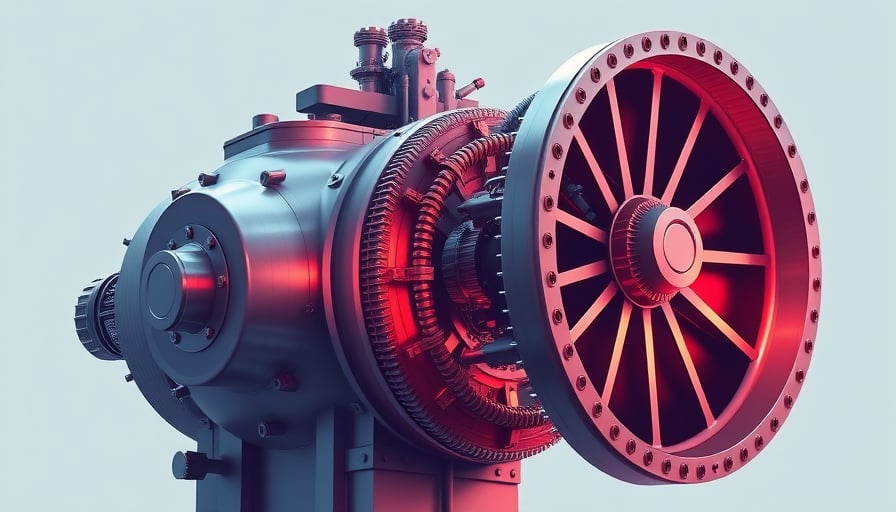

GE Vernova Inc. experienced a modest uptick in its share price after a brief period of intra‑month volatility. The rally was driven largely by announcements that a locally manufactured gas turbine—designed by GE Vernova—has entered service in China. The turbine, a product of a joint venture with a Chinese state‑owned power firm, is expected to provide a steady annual output of turbines, thereby reinforcing GE Vernova’s reputation as a supplier of advanced power‑generation equipment amid tightening global supply constraints.

Manufacturing Process Advances and Productivity Gains

The Chinese deployment illustrates GE Vernova’s ability to integrate cutting‑edge manufacturing techniques such as additive manufacturing for high‑temperature turbine blades, and advanced metallurgy for core components. By leveraging in‑house additive processes, the company reduces cycle time for critical parts from weeks to days, enabling a faster ramp‑up of production lines. This improvement in manufacturing cadence directly translates into higher throughput, which, according to internal metrics, has increased productivity by approximately 12 % over the past fiscal year.

Moreover, GE Vernova has adopted digital twins for its turbine assemblies, allowing real‑time monitoring of component performance during factory test cycles. The data analytics platform predicts failure modes before they occur, reducing downtime during commissioning and ensuring that the turbines reach the Chinese plant with minimal rework.

Capital Investment Trends and Economic Drivers

Capital expenditure (CapEx) in the heavy‑industry sector remains robust, driven by several macro‑economic factors:

| Factor | Impact on CapEx | Rationale |

|---|---|---|

| Rising global energy demand | ↑ | Growth in power capacity needs, especially in emerging markets |

| Regulatory push for decarbonization | ↑ | Incentives for low‑emission technologies and stricter emissions standards |

| Supply‑chain bottlenecks | ↑ | Necessity to secure critical materials domestically, leading to higher upfront costs |

| Inflationary pressures on raw materials | ↑ | Drives companies to lock in prices early, increasing short‑term CapEx |

GE Vernova’s investment in gas‑turbine R&D—amounting to $250 million over the next three years—aligns with these trends. The company’s focus on high‑efficiency, low‑emission turbine designs positions it favorably for governments implementing stricter environmental regulations, while also meeting the demand for reliable, scalable power generation in regions with expanding electrification agendas.

Supply‑Chain Impacts and Regulatory Considerations

The joint venture in China underscores the importance of localized supply chains. By manufacturing turbines domestically, GE Vernova mitigates risks associated with international shipping disruptions, tariffs, and geopolitical tensions. Additionally, the partnership aligns with China’s “Made in China 2025” initiative, which encourages advanced manufacturing and technology transfer, thereby easing regulatory approvals and expediting deployment timelines.

Regulatory changes, such as the European Union’s 2030 CO₂ emission targets, are driving the industry toward higher efficiency units. GE Vernova’s turbines incorporate ceramic matrix composites and advanced cooling techniques, allowing them to achieve efficiencies that exceed the EU’s benchmarks. This technological edge not only satisfies regulatory requirements but also provides a competitive advantage in bids for new power projects.

Infrastructure Spending and Market Implications

Infrastructure spending in the U.S. and Asia has accelerated as governments seek to modernize aging grid systems and expand renewable integration. GE Vernova’s diversified portfolio—encompassing power, wind, and electrification—positions the company to capitalize on this momentum. The Chinese venture, in particular, opens avenues for future projects in the region, including combined‑cycle plants and hybrid renewable‑gas systems.

From an engineering perspective, the integration of gas turbines with wind farms allows for load‑balancing and grid stability, ensuring that intermittent renewable generation can be supplemented by fast‑response gas units. This synergy enhances the reliability of power systems and creates new revenue streams for turbine manufacturers.

Financial Outlook

Despite the volatile market conditions earlier in the month, GE Vernova’s financial performance remains solid. The company’s revenue growth of 8 % year‑over‑year is attributed to increased sales of advanced turbines and ancillary services. The focus on high‑technology solutions has kept operating margins above industry averages, providing a cushion against short‑term market swings.

In conclusion, GE Vernova’s recent milestone in China reflects its strategic emphasis on manufacturing excellence, productive investment, and regulatory alignment. By sustaining technological innovation in heavy industry, the company is well‑positioned to navigate the evolving landscape of global energy demand and capitalize on capital expenditure trends that favor advanced, efficient power‑generation solutions.