Gallagher & Co. Rides the Wave of Growth, But at What Cost?

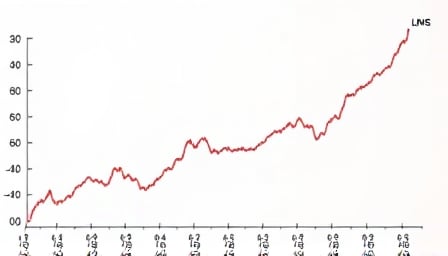

Arthur J Gallagher & Co. has just released its Q1 results, and the numbers are looking good - but scratch beneath the surface and you’ll find a more complex story. The company’s stock price has been on a wild ride, fluctuating between $250.72 and $350.70 over the past 52 weeks, with a current price of $347.44.

The Numbers Don’t Lie

- The company’s sales have increased, but what does that really mean? Is it a sustainable growth trend or just a one-time fluke?

- The stock’s price-to-earnings ratio stands at a whopping 51.58, indicating a premium valuation that may not be justified by the company’s underlying performance.

- The price-to-book ratio of 3.85 suggests a moderate level of leverage, but what does that mean for the company’s long-term financial health?

A Closer Look at the Numbers

The current price is near the 52-week high, which is a clear indication of strong market performance - but is it a sign of underlying strength or just a speculative bubble waiting to burst? The company’s stock price has been on a tear, but what happens when the music stops?

The Bottom Line

Gallagher & Co.’s Q1 results may look good on paper, but investors would do well to take a closer look at the underlying numbers. Is this a sustainable growth trend or just a one-time fluke? Only time will tell, but one thing is certain - investors need to be cautious and do their due diligence before jumping on the Gallagher & Co. bandwagon.

The Risks Are Real

- High price-to-earnings ratio: a premium valuation that may not be justified by the company’s underlying performance.

- Moderate level of leverage: what does that mean for the company’s long-term financial health?

- Speculative bubble: is the current price a sign of underlying strength or just a speculative bubble waiting to burst?

The Verdict

Gallagher & Co.’s Q1 results may be good news for the company’s shareholders, but investors need to be cautious and do their due diligence before making any investment decisions. The risks are real, and investors need to be aware of them before jumping on the Gallagher & Co. bandwagon.