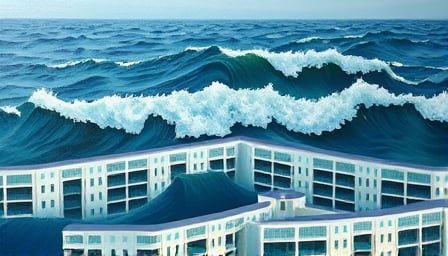

Franklin Resources Faces Turbulent Times

Franklin Resources Inc, a stalwart in the financial advisory services sector, is navigating treacherous waters. The company’s Western Asset Management Co unit has experienced unprecedented outflows, exceeding a staggering $120 billion. This unprecedented exodus has prompted intensified scrutiny and oversight of the unit, underscoring concerns about the company’s ability to retain its market share.

The situation is further complicated by the CEO’s candid admission that institutional investors are increasingly redirecting their assets away from US markets due to the ongoing tariff disputes. This shift in investor sentiment has significant implications for Franklin Resources, as it seeks to maintain its market position in an increasingly volatile environment.

The company’s stock price has been a microcosm of its tumultuous fortunes, plummeting to a recent close below its 52-week low. This precipitous decline has raised questions about the company’s financial performance and its ability to adapt to the evolving market landscape.

Key Challenges Facing Franklin Resources

- Unprecedented outflows from Western Asset Management Co unit, exceeding $120 billion

- Institutional investors shifting assets away from US markets due to tariffs

- Volatile stock price, with recent close below 52-week low

- Intensified scrutiny and oversight of Western Asset Management Co unit

As the company navigates this complex and rapidly evolving landscape, investors will be watching closely to see how Franklin Resources responds to these challenges. Will the company be able to adapt and emerge stronger, or will these turbulent times prove to be a turning point in its fortunes? Only time will tell.