Experian Takes the Lead in Financial Sector

Experian PLC, a stalwart in the professional services industry, has made a bold statement in the financial sector with a series of strategic moves that demonstrate its unwavering commitment to innovation and growth. The company’s subsidiary has issued a whopping $500 million in 10-year bonds, a move that screams financial stability and a vote of confidence in the company’s future prospects.

But that’s not all - Experian has also partnered with Kelley Blue Book to revolutionize the automotive industry with better vehicle history reports. This move is a masterstroke, as it enhances trust and transparency in the market, giving buyers a much-needed edge in making informed purchasing decisions. By providing buyers with accurate and reliable information, Experian is not only setting a new standard in the industry but also cementing its position as a leader in the field.

Experian’s expertise in credit scoring and risk management has also been recognized, with a recent article highlighting the importance of achieving a near-perfect credit score by age 35. This is a wake-up call for many, as it underscores the significance of maintaining a healthy credit score in today’s economy. By providing valuable insights and guidance, Experian is empowering individuals to take control of their financial lives and make informed decisions about their credit.

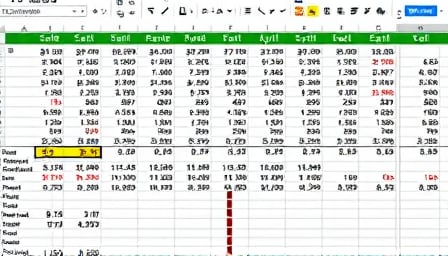

But what’s truly impressive is Experian’s stock price, which has shown a notable increase over the past year. This is a clear indication that investors are taking notice of the company’s strategic moves and are willing to put their money where their mouth is. With a stock price on the rise, Experian is an attractive investment opportunity that’s not to be missed.

Key Takeaways:

- Experian’s $500 million bond issue is a testament to its financial stability and commitment to growth.

- The partnership with Kelley Blue Book is a game-changer in the automotive industry, enhancing trust and transparency in the market.

- Experian’s expertise in credit scoring and risk management is unparalleled, making it a go-to resource for individuals looking to improve their credit.

- The company’s stock price has shown a notable increase over the past year, making it an attractive investment opportunity.

In conclusion, Experian’s recent moves are a clear indication of its commitment to innovation and growth in the financial sector. With its strategic partnerships, financial stability, and expertise in credit scoring and risk management, Experian is poised to take the lead in this rapidly evolving industry.