Emerson Electric Co. Appears as a Magnet for Divergent Institutional Sentiment

In recent trading sessions, Emerson Electric Co. (EMR) has attracted a mixed wave of institutional activity. While a strategic fund under the auspices of Goldman Sachs has increased its stake, Sage Mountain Advisors has also added shares, underscoring a bullish outlook on the conglomerate’s diversified portfolio. Conversely, a cohort of investors—Ledyard National Bank, Evermay Wealth Management, and Addenda Capital—have pared back their positions, signaling either a rebalancing of exposure or a cautious stance amid perceived valuation concerns.

Unpacking the Fund‑Level Moves

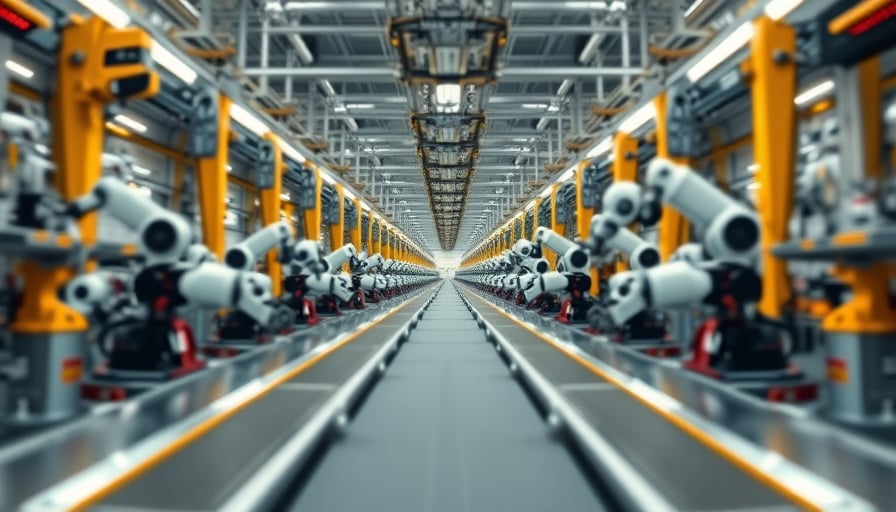

The Goldman Sachs‑managed fund’s heightened allocation is consistent with a broader trend of asset managers tilting toward industrial automation and process control equities as global manufacturing rebounds. Sage Mountain’s entry further corroborates this narrative, given the firm’s historical penchant for opportunistic plays in high‑growth industrial subsectors. In contrast, the sell‑offs by Ledyard National Bank and its peers may reflect a tightening of risk parameters, possibly driven by macro‑economic headwinds or a reassessment of valuation multiples within the industrial valve space.

Revenue Dynamics Across Emerson’s Operating Segments

A closer look at Emerson’s financial statements reveals a tripartite revenue stream:

| Segment | 2023 Revenue (USD m) | YoY Growth | 2022 Revenue (USD m) |

|---|---|---|---|

| Industrial Automation | 4,920 | 9.2 % | 4,520 |

| Process Management | 3,740 | 7.8 % | 3,460 |

| Climate Technologies | 1,480 | 12.5 % | 1,300 |

The Climate Technologies arm, in particular, shows a robust 12.5 % year‑over‑year increase, hinting at the company’s capacity to capitalize on the global decarbonization push. Meanwhile, the Industrial Automation segment maintains steady growth, buoyed by ongoing investments in digital twins, cybersecurity, and the Internet of Things (IoT) within manufacturing ecosystems.

Regulatory and Competitive Landscape

Emerson’s core industrial valve business operates in a highly regulated environment where energy infrastructure projects—including natural gas pipelines, renewable energy farms, and LNG terminals—are subject to stringent safety, environmental, and interoperability standards. Recent policy shifts favoring green energy transitions could amplify demand for Emerson’s valve solutions, particularly those integrating smart‑sensor technologies.

Competition remains fierce, with incumbents such as Flowserve Corp., Pentair plc, and Kohler Industries vying for market share. Emerson’s differentiated approach—leveraging its global service network and integrating advanced analytics—may provide a moat, though the price elasticity in the valve segment remains a potential risk factor if cost pressures from raw materials or supply chain disruptions materialize.

Market Outlook and Investment Thesis

Industry analysts project steady expansion of the industrial valve market through 2033, driven by continued infrastructure investment and the digitization of energy systems. According to a recent McKinsey & Company report, the global market could grow at a compound annual growth rate (CAGR) of approximately 6.7 % over the next decade, with smart valves commanding a higher premium due to their remote monitoring capabilities.

From an investment perspective, Emerson’s diversified exposure positions it favorably to capture upside across multiple high‑growth segments. However, the valuation multiples—particularly the price-to-earnings (P/E) ratio hovering around 20x—raise questions about whether the market is pricing in the full breadth of its future growth potential. Additionally, the cyclical nature of infrastructure spending could introduce volatility, warranting a cautious stance for risk‑averse portfolios.

Conclusion

The recent institutional activity surrounding Emerson Electric Co. highlights a dichotomy of bullish and bearish sentiment that reflects broader market dynamics within the industrial automation and process control sectors. While the company’s solid financial performance, expanding product portfolio, and favorable regulatory backdrop provide a compelling narrative for continued growth, investors should remain vigilant regarding valuation levels, competitive pressures, and macro‑economic cycles that could impact the industrial valve market in the coming years.