EchoStar Corp’s Spectrum Sale Signals Strategic Shift

EchoStar Corporation, a Nasdaq‑listed satellite communications provider, recently completed a substantial spectrum transaction that is poised to reshape its strategic trajectory within the U.S. wireless ecosystem. The company sold a sizable spectrum asset to AT&T and SpaceX, a move analysts interpret as a definitive exit from its ambition to operate as a fourth mobile network operator in the United States.

Implications for FCC Auction Planning

The transfer of spectrum under the OBBBA (Over‑the‑Airband, Broadband, Broadcast, and Broadband Access) framework carries implications for future Federal Communications Commission (FCC) auction strategies. By relinquishing the asset, EchoStar reduces the pool of high‑value frequencies that the FCC might otherwise allocate to new entrants. This could influence the allocation of scarce spectrum resources, prompting regulators to reassess auction designs and potentially accelerate the adoption of alternative deployment models, such as low‑earth‑orbit satellite constellations.

Market Reaction and Analyst Sentiment

Financial markets have responded with a spectrum of views. Deutsche Bank has retained a buy recommendation on EchoStar, underscoring a cautiously optimistic outlook that the company’s core satellite operations remain robust. Other market commentary has noted a general uptick in Asian equity indices, citing oil price dynamics as a primary driver. However, these macro‑economic developments appear largely orthogonal to EchoStar’s core business, which is anchored in satellite infrastructure rather than commodity‑linked activities.

Strategic Reorientation

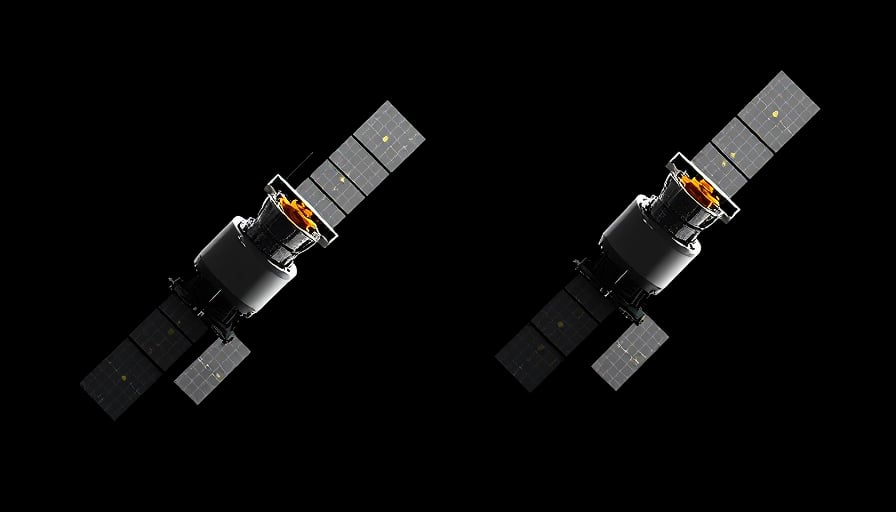

The spectrum sale marks a pivotal reorientation for EchoStar. By divesting from the high‑capital, high‑competition mobile operator arena, the firm can redirect capital, talent, and operational focus toward enhancing its satellite infrastructure and service portfolio. Key customer segments—media and broadcast, enterprise, and government—continue to demand resilient, high‑throughput connectivity that EchoStar’s satellite platform is uniquely positioned to deliver.

Cross‑Sector Implications

EchoStar’s shift mirrors broader industry trends where satellite operators are increasingly partnering with terrestrial carriers and space‑launch firms to offer hybrid connectivity solutions. The collaboration with AT&T and SpaceX suggests a growing convergence between satellite and terrestrial wireless markets, potentially catalyzing new business models that blend fixed‑satellite broadband with mobile network capabilities. This convergence may, in turn, influence how regulators and policymakers structure future spectrum allocations and licensing regimes.

Conclusion

EchoStar’s spectrum divestiture signals a deliberate exit from the mobile operator race, allowing the company to consolidate its competitive advantages in satellite communications. While the immediate financial market reaction remains mixed, the strategic realignment positions EchoStar to capitalize on emerging demand for resilient, global connectivity across media, enterprise, and government sectors. The move also carries broader ramifications for FCC auction planning and the evolving interplay between satellite and terrestrial wireless ecosystems.