DraftKings Charts Course for Growth Amid Regulatory Uncertainty

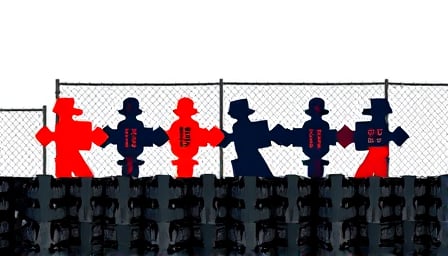

As the daily fantasy sports and betting landscape continues to evolve, DraftKings is positioning itself for a resurgence, driven by its commitment to enhancing customer engagement and expanding its live betting capabilities. However, the company’s prospects for growth remain inextricably linked to the ongoing quest for further legalization of its services.

In a move that has sent shockwaves through the industry, DraftKings has been exploring a potential acquisition by the UK-based sports betting giant, Bet365. While the details of this proposed deal remain shrouded in mystery, it is clear that such a partnership would significantly bolster DraftKings’ market presence and capabilities.

Meanwhile, BlackRock has reduced its stake in the company, a development that has contributed to the volatility in DraftKings’ stock price. Some analysts have suggested that the company’s shares may be undervalued, given its potential for growth and expansion in the rapidly evolving sports betting landscape.

As the company prepares to report its earnings, investors will be closely watching for any signs of progress on the regulatory front, as well as any updates on the proposed acquisition by Bet365. The outcome of these developments will undoubtedly have a significant impact on the company’s stock price and its prospects for growth in the months ahead.

Key Developments to Watch:

- Regulatory progress on further legalization of DraftKings’ services

- Outcome of the proposed acquisition by Bet365

- Earnings report and subsequent stock price reaction

- Potential impact of BlackRock’s reduced stake on the company’s stock price and market value