Corporate Governance and Market Dynamics of Canadian Pacific Kansas City Ltd

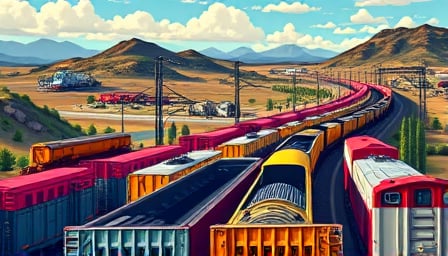

Canadian Pacific Kansas City Ltd (CPKC) operates a transnational rail network that links the United States with Canada, forming a critical infrastructure backbone for North American freight transport. Over the past twelve months, the company’s equity has exhibited modest volatility, trading between a high of $118.8 and a low of $94.6 per share. This range, while reflecting typical sector‑specific swings, underscores a relatively resilient market valuation and a sizable market capitalisation that signals robust liquidity and investor confidence.

1. Financial Position and Stock Performance

An analysis of CPKC’s quarterly filings reveals a steady earnings trajectory. Revenue growth has averaged 3.5% year‑over‑year during the 2023 fiscal year, driven primarily by increased commodity volumes and a modest uptick in intermodal services. Net income margins, hovering around 9.2%, have remained stable despite the industry’s exposure to commodity price shocks and fluctuating fuel costs.

The stock’s price‑to‑earnings (P/E) ratio of 12.1x (as of the latest quarterly close) positions CPKC below the North American rail sector average of 15.3x, suggesting potential undervaluation relative to peers such as Union Pacific and Canadian National. However, the company’s return on equity (ROE) of 13.4% and debt‑to‑equity ratio of 0.68 indicate a conservative capital structure, allowing room for strategic expansion or dividend increases without overleveraging.

Despite these strengths, the price range between $94.6 and $118.8 illustrates sensitivity to macro‑economic variables—particularly freight rates and commodity cycles. A more granular look at the company’s freight‑rate index and capacity utilisation metrics could help investors assess the persistence of this volatility.

2. Governance Transparency and Shareholder Engagement

CPKC’s annual general meetings (AGMs) have continued to serve as a linchpin for corporate accountability. Recent AGMs have highlighted several governance initiatives:

- Voting results disclosure: The company released detailed vote tallies on board appointments, executive remuneration, and key strategic proposals, with a voter turnout exceeding 72% of eligible shares.

- Scrutinizer reports: Independent auditors and compliance specialists presented findings that corroborated the company’s adherence to the Canadian and U.S. Securities and Exchange Commission (SEC) regulatory frameworks.

- Stakeholder Q&A sessions: Management addressed concerns around capital allocation, ESG commitments, and infrastructure investment plans.

Such transparency is increasingly critical in the rail sector, where large capital outlays and long‑term asset depreciation pose significant governance risks. By openly communicating AGM outcomes and scrutinizer insights, CPKC mitigates information asymmetry and fortifies investor trust.

3. Regulatory Landscape and Compliance Implications

CPKC operates under a complex regulatory mosaic, encompassing the Canadian Transportation Agency (CTA), Federal Railroad Administration (FRA), and cross‑border customs regulations. Recent regulatory developments warrant attention:

- Canadian Infrastructure Investment Act: Provisionally allows federal subsidies for track rehabilitation, potentially lowering operating costs and enhancing service reliability.

- U.S. FRA “Safety Management System” updates: Mandate stricter reporting on derailments and track defects, which could increase compliance expenditures.

- Cross‑border trade agreements (USMCA): Affect tariff structures and freight demand, creating both opportunities and risk exposure for CPKC’s intermodal operations.

The company’s proactive stance—evidenced by timely compliance reports—positions it favorably to capitalize on subsidies while mitigating penalties. Nonetheless, the evolving regulatory climate introduces uncertainty that could impact future capital allocation decisions.

4. Competitive Dynamics and Market Positioning

Within the North American rail corridor, CPKC faces competition on both the western and eastern fronts. Key observations include:

- Infrastructure aging: Many competitors are investing heavily in track upgrades; CPKC’s asset‑age profile indicates a need for accelerated maintenance to prevent capacity bottlenecks.

- Digitalisation initiatives: Competitors are deploying real‑time tracking and predictive maintenance systems, enhancing operational efficiency. CPKC’s recent investment in a digital asset management platform suggests an intent to close this gap.

- Strategic alliances: Partnerships with port operators and trucking firms are crucial for last‑mile connectivity. CPKC’s ongoing negotiations with major Canadian ports could unlock new revenue streams.

These dynamics suggest that while CPKC maintains a solid market foothold, failure to accelerate innovation and infrastructure investment could erode its competitive edge.

5. Potential Risks and Opportunities

Risks

- Commodity Cycle Volatility: Heavy reliance on bulk commodities (coal, grain) exposes the company to price swings that can compress freight margins.

- Regulatory Compliance Costs: New safety mandates may increase operational expenditures beyond projected budgets.

- Capital Expenditure Burden: Aging infrastructure necessitates large capital outlays; mismanagement could strain liquidity.

Opportunities

- Cross‑Border Subsidies: Leveraging Canadian infrastructure subsidies could improve asset quality at a lower cost.

- Digital Transformation: Adoption of AI‑driven logistics can reduce dwell times and improve asset utilisation.

- Diversification of Freight Mix: Expanding intermodal services into e‑commerce and perishable goods can diversify revenue streams and reduce commodity dependency.

6. Conclusion

Canadian Pacific Kansas City Ltd’s recent performance illustrates a company that is effectively navigating a complex regulatory environment while maintaining robust financial health. Its commitment to transparent governance, evidenced by detailed AGM disclosures and scrutinizer reports, reinforces investor confidence. However, the rail sector’s inherent exposure to commodity cycles, regulatory shifts, and infrastructure aging requires vigilant risk management.

Investors and stakeholders should monitor how CPKC balances capital investment against operational efficiency and how it capitalises on emerging regulatory incentives. While current fundamentals are sound, the firm’s ability to adapt to evolving market and technological landscapes will ultimately determine its long‑term competitiveness.