Covestro’s Turbulent Times: Voting Rights, Index Exclusions, and Polyol Production

Covestro AG’s recent news has sent shockwaves through the corporate world, with major implications for its share ownership structure and market presence. The company has made a notification regarding significant changes to its voting rights and shareholdings, sparking concerns about its future direction.

- The notification highlights a major shift in Covestro’s ownership landscape, with significant stakes being acquired or divested. This development raises questions about the company’s ability to navigate the complexities of its own share ownership structure.

- Furthermore, Covestro’s impending removal from the STOXX-600 and S&P-500 indices on March 24th has sparked concerns about its market relevance and competitiveness. This exclusion will likely have a negative impact on the company’s stock price and investor confidence.

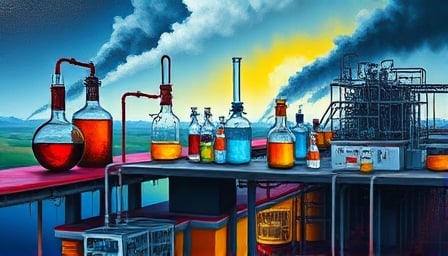

A Polyol Production Conundrum

In a separate development, Covestro has joined forces with LyondellBasell to close a polyol unit, a move that is part of a broader trend of polyol production capacity being withdrawn from the market. This decision has led to price increases for the chemical, which will likely have far-reaching consequences for industries that rely on polyol production.

- The closure of the polyol unit is a significant development, with implications for the global polyol market. As the demand for polyol continues to grow, the reduced production capacity will likely lead to increased prices and supply chain disruptions.

- The partnership between Covestro and LyondellBasell raises questions about the long-term viability of polyol production in the market. Will this development lead to a consolidation of market players, or will it create opportunities for new entrants to emerge?