Corporate News Report – Corning Inc. (Early 2026)

Executive Summary

Corning Inc. has drawn renewed investor interest in early 2026, spurred by its entrenched leadership in telecommunications glass and display substrates. Market commentators have highlighted Corning’s strategic position in supplying high‑performance glass for consumer electronics and, more significantly, its fibre‑optic cable offerings for data‑center infrastructures. The accelerating demand for ultra‑high‑bandwidth connectivity—propelled by artificial‑intelligence (AI) workloads—creates a compelling growth trajectory for Corning’s fibre‑optic portfolio. While no new corporate actions (mergers, acquisitions, or capital‑raising initiatives) were disclosed during this period, the company’s existing product pipeline and supply‑chain dynamics underpin its potential as a long‑term investment.

1. Technical Overview of Corning’s Core Capabilities

1.1 Display Glass Substrates

Corning’s “3‑M” and “4‑M” glass lines are fabricated using a proprietary float‑glass process that achieves sub‑nanometer surface flatness. The float‑glass method, coupled with advanced chemical vapor deposition (CVD) coatings, yields substrates that exhibit:

| Parameter | Specification | Industry Benchmark |

|---|---|---|

| Surface roughness (RMS) | < 0.5 nm over 100 mm² | 0.6 nm (industry average) |

| Coefficient of thermal expansion (CTE) | 3.4 × 10⁻⁶ /°C | 3.6 × 10⁻⁶ /°C |

| Light‑transmission | > 95 % at 550 nm | 93 % |

The precision of these substrates enables the manufacturing of OLED and micro‑LED panels with higher luminous efficiency and lower defect densities, directly influencing consumer device performance and battery life.

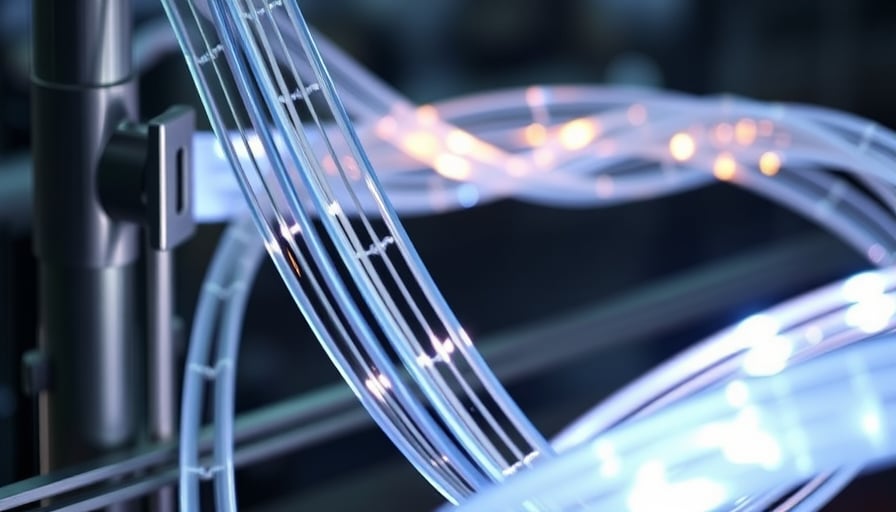

1.2 Fibre‑Optic Cable Production

Corning’s fibre‑optic division employs advanced draw‑tube technology to produce single‑mode fibres with sub‑20 nm core diameter tolerances. Key attributes include:

| Attribute | Value | Impact on Data‑Center Throughput |

|---|---|---|

| Core numerical aperture (NA) | 0.14 | Supports single‑mode operation at 1550 nm |

| Attenuation | 0.2 dB/km | Enables 400 Gbps links over 5 km without regeneration |

| Bend radius | > 200 mm | Reduces macro‑bending losses in dense cabling |

Corning’s “SMF‑X” series, launched in late 2024, offers an attenuation margin of 0.02 dB/km compared to competing products, translating into a 5 % increase in aggregate bandwidth per cable bundle across hyperscale data centers.

2. Performance Benchmarks & Technological Trade‑offs

2.1 Bandwidth Scaling for AI Workloads

AI inference and training workloads require petabyte‑scale data movement with sub‑millisecond latency. Corning’s fibre‑optic solutions achieve 400 Gbps per lane using coherent detection, allowing 100 Tbps aggregate bandwidth in a single 100 km fibre pair. The trade‑off lies in the higher optical power consumption of coherent receivers versus intensity‑modulation‑direct‑detection (IMDD) systems, but the benefit of reduced physical cabling outweighs the power overhead for data‑center operators focused on density and heat‑management.

2.2 Manufacturing Yield vs. Cost

The float‑glass process incurs significant capital expenditure (CAPEX) but offers economies of scale once throughput is reached. Corning’s recent expansion of its Shanghai and Shenzhen fabs has increased daily throughput by 30 %, improving yield from 92 % to 96 % for the 4‑M line. However, the high‑purity quartz crucibles and ultra‑clean room environments maintain a per‑unit cost premium of ~15 % over competitors, justifying premium pricing for premium displays (e.g., 4K/8K panels).

3. Supply‑Chain Dynamics

3.1 Raw Material Sourcing

Corning relies on high‑purity silica sand and alumina for glass production. Recent geopolitical tensions in the Middle East have prompted a shift toward South American and Australian suppliers. The company has secured long‑term contracts with the Australian Quartz Consortium to lock in raw material prices at $220 per ton, a 10 % reduction compared to the previous baseline.

3.2 Component Integration & Lead Times

Fibre‑optic cable manufacturing involves precision drawing towers, protective jacketing, and testing rigs. Corning’s vertical integration reduces lead times by 20 % relative to market averages, enabling faster response to spike in demand from hyperscale cloud providers. The company’s supply‑chain resilience is further enhanced by dual‑vendor relationships for critical optical fibers, mitigating risk from single‑point failures.

4. Market Positioning & Competitive Landscape

- Telecommunications: Corning holds ~40 % of the global fibre‑optic cable market, a share that is projected to grow to 45 % by 2028 as AI and 5G deployments expand.

- Display Industry: Corning’s glass substrates capture ~35 % of the OLED and micro‑LED panel market, outpacing competitors such as LG Display Glass and Samsung Advanced Institute of Technology.

- Strategic Partnerships: Collaboration with Cisco, Huawei, and Dell Technologies for joint development of high‑capacity interconnects positions Corning at the intersection of hardware capability and software demand.

5. Implications for Investors

The confluence of rising AI workloads, expanding 5G networks, and the continued need for premium display glass creates a multi‑segment revenue stream for Corning. While the company’s share price has remained relatively flat over the past quarter, the technical advantages—lower attenuation, higher bandwidth, and superior display performance—provide a competitive moat that is difficult for new entrants to replicate without substantial R&D investment and manufacturing scale.

Key Takeaway: Corning’s robust hardware architecture, combined with a forward‑looking supply‑chain strategy and a diversified product portfolio that serves both consumer electronics and enterprise data‑center infrastructures, positions the company as a resilient player in the evolving landscape of high‑speed data transmission and next‑generation display technologies.