Corning Incorporated Reaches 52‑Week High Amid Analyst Optimism

Corning Incorporated (NYSE: GLW) has recently peaked at a 52‑week high, reflecting a marked appreciation in its share price over the preceding year. The rally is underpinned by a confluence of factors that reinforce the company’s strategic position across multiple high‑growth sectors, notably telecommunications and information display.

Strength of Core Business Segments

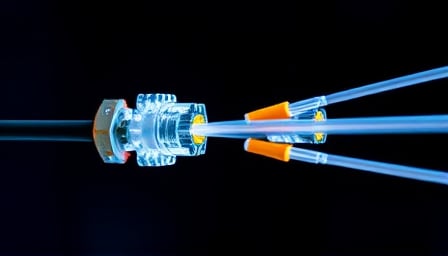

Optical Fiber and Photonic Components

Corning’s long‑standing dominance in the manufacture of optical fiber, cable, and advanced photonic components continues to drive revenue momentum. The firm’s investments in research and development have kept it at the forefront of next‑generation optical technologies, such as high‑capacity fiber‑optic solutions and coherent optical components that underpin 5G infrastructure rollouts.

Information Display Materials

In parallel, Corning’s production of high‑performance glass panels and ancillary display components supports its foothold in the burgeoning information display market. The company’s glass solutions—ranging from advanced TFT‑LCD panels to the latest OLED substrates—have been embraced by major device manufacturers, bolstering sales in both consumer electronics and automotive displays.

Analyst Consensus and Price Target Adjustments

Analyst sentiment has trended bullish, with UBS elevating its price target for Corning to $91 per share and Citigroup following suit by raising its own target. These revisions are based on:

- Robust earnings outlook: Projected earnings growth remains strong, buoyed by higher gross margins in the optical and display segments.

- Strategic acquisitions: Recent deals have expanded Corning’s intellectual property portfolio and customer base, providing a competitive moat.

- Capital allocation discipline: The company’s commitment to disciplined free‑cash‑flow generation and shareholder returns through dividends and share buybacks enhances its valuation profile.

Market Capitalization and Valuation Metrics

Corning’s market capitalization has expanded appreciably, reflecting investor confidence in its long‑term growth trajectory. Its current price‑to‑earnings (P/E) ratio, while comparatively high, is justified by the company’s dominant market position and the anticipated acceleration of demand in both telecommunications and display markets. This valuation premium signals market optimism about Corning’s ability to convert its technological capabilities into sustained profitability.

Risk Considerations

Despite the favorable outlook, the stock remains subject to broader market volatility. Key risks include:

- Supply chain disruptions: The semiconductor and raw‑material supply chains could affect production timelines and cost structures.

- Competitive pressure: Emerging players in optical and display technologies could erode Corning’s market share if they deliver cost‑competitive alternatives.

- Macroeconomic headwinds: Inflationary pressures and potential interest‑rate hikes may compress consumer spending and corporate investment in telecommunications and electronics.

Conclusion

Corning Incorporated’s recent 52‑week high reflects a confluence of solid fundamentals, strategic positioning in high‑growth sectors, and a supportive analyst environment. While valuation metrics suggest a premium, the company’s entrenched market presence and disciplined financial management provide a credible basis for continued upside. Investors should remain cognizant of systemic risks while recognizing the strategic advantages that position Corning to capitalize on evolving industry dynamics.