Copart’s Rollercoaster Ride: A Critical Examination of the Company’s Stock Performance

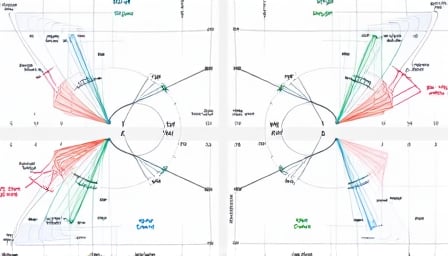

Copart, the US-based online vehicle auctioneer, has been on a wild ride in the past year, with its stock price fluctuating wildly like a yo-yo on steroids. The numbers are stark: a 52-week high of $64.38 USD on November 26th, 2024, followed by a 52-week low of $48.05 USD on September 10th of the same year. And if you thought things were settling down, think again - the current price of $48.59 USD is a far cry from the highs of just a few months ago.

But what does this rollercoaster ride say about Copart’s financial health? Let’s take a closer look at the numbers. The company’s price-to-earnings ratio of 33.04 is a red flag, indicating that investors are willing to pay a premium for Copart’s shares. But is this premium justified? The price-to-book ratio of 5.50 is also cause for concern, suggesting that investors are overvaluing the company’s assets.

Here are the key takeaways from Copart’s stock performance:

- 52-week high: $64.38 USD (November 26th, 2024)

- 52-week low: $48.05 USD (September 10th, 2024)

- Current price: $48.59 USD

- Price-to-earnings ratio: 33.04

- Price-to-book ratio: 5.50

In conclusion, Copart’s stock performance is a cautionary tale of the dangers of speculation and overvaluation. While the company’s online vehicle auction business may be booming, the numbers suggest that investors are getting ahead of themselves. As the old adage goes, “don’t count your chickens before they hatch.” In this case, investors would do well to take a step back and reassess their expectations.