ConocoPhillips Draws Sustained Analyst Interest Amid Long‑Term Value Outlook

ConocoPhillips, a prominent independent exploration and production firm listed on the New York Stock Exchange, has recently captured renewed attention from market participants. A comprehensive review conducted by Jefferies reiterates a buy recommendation for the company, accompanied by a target price that reflects confidence in the firm’s prospects beyond 2030.

Analytical Rigor in Assessing an Energy Leader

The Jefferies assessment underscores several key strengths that position ConocoPhillips favorably within the broader energy landscape:

| Factor | Assessment | Implication |

|---|---|---|

| Resource Base | Diverse portfolio of crude oil, natural gas, and associated liquids | Provides revenue resilience against commodity volatility |

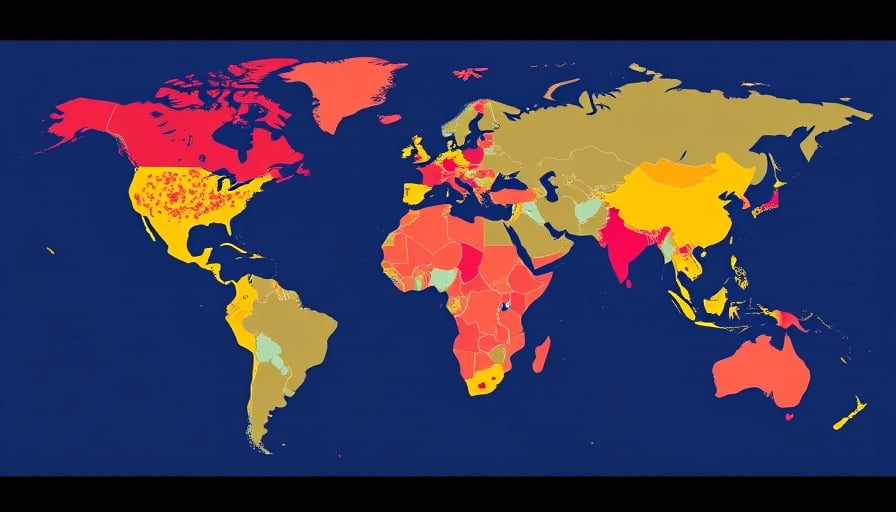

| Geographic Scale | Operations spanning North America, Australia, and the Middle East | Mitigates regional supply disruptions |

| Operational Efficiency | Proven track record of cost discipline and high recoveries | Enhances margins in a low‑price environment |

| Capital Allocation | Strategic investment in high‑potential fields, disciplined divestments | Supports sustainable long‑term growth |

By evaluating ConocoPhillips through these lenses, analysts emphasize that the company’s competitive positioning is not merely a function of current market conditions but rooted in fundamental business principles such as asset quality, operational excellence, and disciplined capital deployment.

Market Drivers Beyond Oil and Gas

While ConocoPhillips remains fundamentally an energy company, its performance is increasingly intertwined with macroeconomic forces that cut across sectors:

- Inflationary Dynamics – Rising energy prices often act as a hedge against inflation, influencing the company’s earnings outlook.

- Geopolitical Tensions – Ongoing instability in key supply regions can shift demand curves, affecting both crude and natural gas markets.

- Transition to Renewables – The shift toward low‑carbon energy sources pressures traditional players to diversify; ConocoPhillips’ investment in carbon capture and storage projects signals proactive adaptation.

- Supply Chain Resilience – Global disruptions underscore the importance of robust logistics and diversified sourcing—areas where ConocoPhillips’ scale offers an advantage.

These drivers demonstrate how an energy company’s fortunes are inextricably linked to broader economic trends, reinforcing the need for analysts to adopt an interdisciplinary perspective.

Investor Perception and Sectoral Context

ConocoPhillips’ status as a focal point for investors seeking energy exposure is corroborated by market commentary that highlights its global scale and diversified asset mix. The firm’s ability to generate stable cash flows in a cyclical industry, while maintaining a clear long‑term strategic vision, aligns with investor demand for both yield and growth potential.

Moreover, the company’s emphasis on technological innovation—such as advanced drilling techniques and real‑time data analytics—illustrates how traditional exploration and production can incorporate cutting‑edge solutions to enhance efficiency and reduce environmental impact.

Conclusion

The sustained analyst endorsement of ConocoPhillips reflects a nuanced understanding of the company’s operational strengths, market positioning, and alignment with macroeconomic trends. By applying rigorous, sector‑agnostic analytical frameworks, stakeholders gain a comprehensive view of the firm’s capacity to deliver long‑term value. As the energy sector continues to navigate a complex landscape of supply, demand, and policy shifts, ConocoPhillips remains a compelling case study of how robust fundamentals and strategic adaptability can coexist in a rapidly evolving environment.