Corporate News

Canadian National Railway Co. (CN) has announced a strategic restructuring aimed at reducing its non‑unionized workforce by approximately 6 %, translating to about 400 management positions across Canada and the United States. The company projects that this measure will generate annual cost savings of roughly US $75 million, while positioning CN for sustainable, long‑term growth through operational streamlining.

Rationale and Expected Impact

CN’s decision reflects a broader industry trend toward leaner, more agile organizational structures in the face of heightened competition and evolving freight demands. By eliminating redundant managerial functions, CN intends to:

- Improve operational efficiency: A leaner management layer can reduce bureaucratic overhead, allowing faster decision‑making and tighter coordination among freight operations.

- Strengthen financial resilience: The projected $75 million in annual savings will bolster CN’s balance sheet, providing a buffer against cyclical downturns in commodity and consumer transport.

- Reallocate resources: Savings can be redirected toward capital investment in automation, digital platforms, and infrastructure upgrades, keeping the company competitive in a rapidly digitizing logistics landscape.

Sector Context

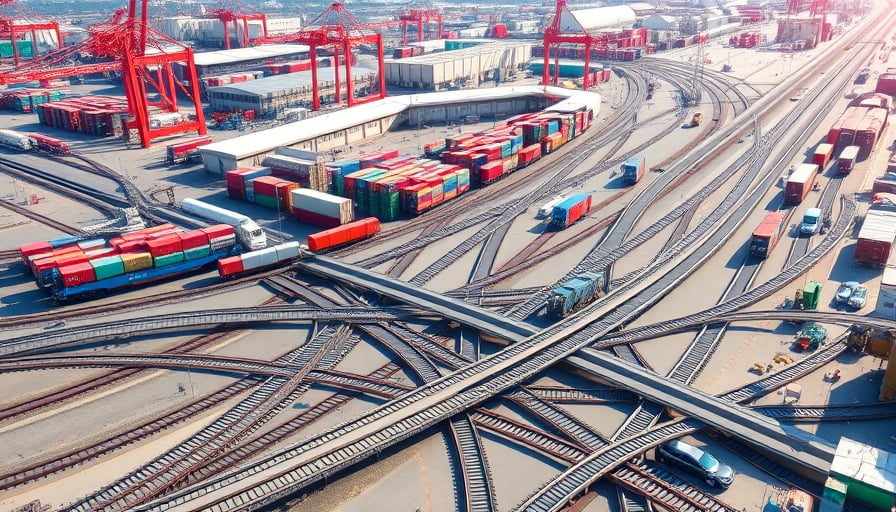

Rail freight remains a backbone of North American supply chains, especially for bulk commodities such as grain, minerals, and energy products. However, the sector faces mounting pressure from alternative modes (truck, rail‑road hybrids, and emerging intermodal solutions) and from regulatory changes aimed at enhancing sustainability. In this environment, efficient cost structures are essential for maintaining margins.

CN’s restructuring mirrors moves by other major rail operators, such as Canadian Pacific Railway and Union Pacific, which have also pursued workforce optimization and technology adoption to improve service reliability and profitability. The reduction in management roles is particularly significant, as it signals a shift toward flatter governance models that can respond more swiftly to market signals.

Cross‑Industry Implications

The emphasis on streamlining resonates beyond the rail industry. In transportation and logistics, firms across trucking, shipping, and air freight are reexamining their organizational hierarchies to cut fixed costs and accelerate digital transformation. Similarly, in manufacturing, many companies are reducing supervisory layers to foster rapid innovation cycles and improve supply‑chain responsiveness.

Moreover, the $75 million annual saving aligns with broader macroeconomic trends in cost containment, especially amid inflationary pressures and volatile commodity prices. By tightening its cost base, CN positions itself to better weather macroeconomic fluctuations and to capture market share when competitors are constrained by higher operating expenses.

Conclusion

CN’s workforce reduction represents a calculated effort to align its organizational structure with contemporary competitive imperatives. The expected annual savings of $75 million should provide the financial flexibility needed to invest in technology and infrastructure, reinforcing CN’s role as a key player in North America’s freight network. As the railway continues to focus on efficiency while maintaining its extensive network, the decision underscores the importance of strategic workforce planning in achieving long‑term corporate sustainability.