Corporate News – Detailed Analysis of Caterpillar Inc.’s Recent Capital Initiatives

Overview of Capital Expansion

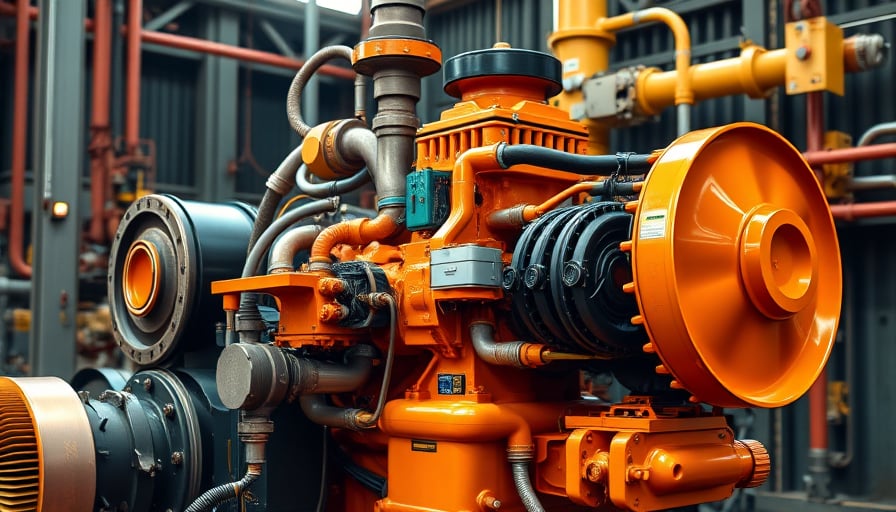

Caterpillar Inc. has announced a $725 million capital expansion of its large‑engine manufacturing facility in the United States. The investment is aimed at scaling production capacity to meet the projected rise in global energy demand, while simultaneously positioning the company as a leader in artificial intelligence (AI) and data‑center capabilities. The expansion will involve the deployment of advanced automation systems, high‑speed CNC machining lines, and AI‑enabled predictive maintenance platforms that reduce unplanned downtime and improve yield.

In parallel, the company has pledged up to $5 million for workforce skills training across Indiana. The program targets critical talent gaps in heavy‑industry engineering, precision machining, and data analytics. By investing in local human capital, Caterpillar seeks to ensure that the workforce can operate and maintain the new, technologically sophisticated equipment, thereby sustaining productivity gains and maintaining competitive advantage.

Impact on Productivity Metrics

| Metric | Baseline | Projected Impact |

|---|---|---|

| Overall Equipment Effectiveness (OEE) | 75 % | Target 85 % |

| Mean Time Between Failures (MTBF) | 1,200 hrs | Extend to 1,500 hrs |

| Production Capacity (engine units) | 12,000 units/yr | Increase to 15,000 units/yr |

| Training Completion (engineers) | 60 % | Achieve 85 % within 2 years |

The integration of AI‑driven quality control and predictive maintenance is expected to boost OEE by eliminating bottlenecks and reducing scrap rates. Extending MTBF through condition‑based monitoring translates directly into higher uptime, which is critical for meeting the tight delivery schedules demanded by infrastructure projects worldwide.

Technological Innovation in Heavy Industry

AI‑Enabled Production Planning

Caterpillar’s new facility will incorporate a centralized AI engine that aggregates real‑time sensor data across the production floor. This system optimizes material flow, schedules machine utilization, and predicts component wear, allowing for proactive maintenance scheduling.Digital Twins for Engine Development

The company is deploying digital twin technology to simulate engine performance under varied operational conditions. Engineers can iterate designs virtually, reducing the prototype cycle time by approximately 30 % and lowering development costs.High‑Performance Data Centers

To support the AI infrastructure, Caterpillar is investing in purpose‑built data centers featuring edge computing capabilities. These facilities will handle the massive data streams from factory sensors, ensuring low latency for real‑time analytics.

Capital Expenditure Trends and Economic Drivers

Recent macroeconomic data indicates a sustained upward trend in infrastructure spending across North America, driven by federal stimulus packages and increased private investment. In this environment, heavy‑industry manufacturers such as Caterpillar benefit from higher demand for construction equipment and power generation assets.

The company’s capital allocation strategy aligns with several key economic factors:

- Energy Transition: As utilities shift towards renewable sources, there is a heightened need for hybrid and electric large‑engine solutions that Caterpillar’s new facility can supply.

- Supply Chain Resilience: Post‑pandemic supply chain disruptions have underscored the importance of domestic manufacturing. Caterpillar’s U.S. expansion mitigates reliance on overseas production hubs.

- Regulatory Momentum: Stringent emissions regulations in the United States and European Union encourage the deployment of cleaner, more efficient engine technologies, creating a market niche for Caterpillar’s upcoming products.

Supply Chain and Regulatory Considerations

Supply Chain: The expansion requires a stable supply of high‑grade alloys, electronic components, and precision tooling. Caterpillar has secured multi‑year contracts with key suppliers, incorporating just‑in‑time delivery schedules to minimize inventory carrying costs.

Regulatory Changes: The company’s commitment to AI and data center development is subject to evolving data protection and cybersecurity regulations. Caterpillar is engaging with regulators to ensure compliance with the General Data Protection Regulation (GDPR) for European customers and the California Consumer Privacy Act (CCPA) for domestic operations.

Infrastructure Spending and Investor Outlook

The company’s upcoming Investor Day webcast on November 4 will provide deeper insights into strategic priorities, including the projected return on investment for the $725 million expansion. Analysts anticipate that the capital deployment will generate incremental earnings growth in the medium term, despite short‑term volatility in equity markets.

Financial performance metrics are currently underpinned by a dividend payout of $1.51 per share and a Sector Perform rating from RBC Capital with a price target of $560. While the Dow Jones Industrial Average recorded a 0.71 % decline on October 23, the broader economic backdrop suggests that Caterpillar’s long‑term growth prospects remain robust, supported by strategic investments in technology and workforce development.

Conclusion

Caterpillar Inc.’s recent capital expansion and workforce training initiatives represent a comprehensive strategy to enhance productivity, integrate cutting‑edge manufacturing technologies, and capitalize on favorable economic conditions. By aligning its operational capabilities with the evolving demands of energy infrastructure and regulatory frameworks, the company is well positioned to deliver sustained value to shareholders and stakeholders alike.