BHP’s Copper Conundrum: Can the Mining Giant Overcome Red Tape and Global Uncertainty?

BHP Group Ltd, the Australian mining behemoth, has seen its shares experience a moderate increase in value over the past few days. But don’t be fooled – this uptick is not a reflection of the company’s operational prowess, but rather a testament to its ability to navigate the treacherous waters of global economic uncertainty.

Goldman Sachs, the investment banking giant, remains bullish on BHP, citing its resilience in the face of adversity. But what exactly does this mean? Is BHP’s resilience a result of its own doing, or is it simply a product of its size and market influence? The answer, much like the company’s aging copper mines in Chile, is shrouded in mystery.

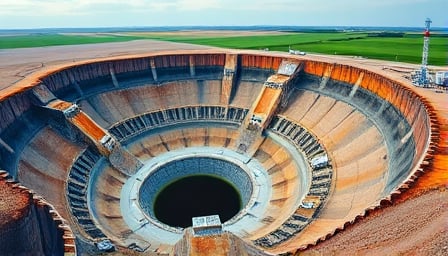

The project to overhaul these mines, a multi-billion dollar endeavor, has been hindered by red tape. This is not a surprise – the Chilean government’s bureaucratic labyrinth has been notorious for stifling business growth. But BHP’s inability to overcome these obstacles raises serious questions about its ability to execute on its ambitious plans.

Despite these concerns, BHP’s shares have shown a slight uptick in value. Some market analysts are optimistic about the company’s prospects, citing its ability to adapt to global trade tensions. But what exactly does this mean? Is BHP’s ability to adapt a result of its own strategic vision, or is it simply a product of its size and market influence?

The Dividend Dilemma

BHP has announced its interim dividend, with details of the dividend reinvestment plan made available to shareholders. But what does this mean for investors? Is the dividend a sign of the company’s financial health, or is it simply a way to placate shareholders while the company’s underlying issues remain unaddressed?

The Bottom Line

BHP’s shares may have experienced a moderate increase in value, but this is not a reflection of the company’s operational prowess. Rather, it is a testament to its ability to navigate the treacherous waters of global economic uncertainty. But for how long can BHP continue to rely on its size and market influence to prop up its shares? The answer, much like the company’s aging copper mines in Chile, remains shrouded in mystery.