Corporate Action and Market Dynamics at British American Tobacco PLC

British American Tobacco (BAT) PLC disclosed a series of corporate actions on 18 November that have attracted analyst attention and may influence short‑term market sentiment. The actions comprise a share‑buyback transaction executed via Goldman Sachs International, concurrent management share purchases, and the filing of a regulatory disclosure detailing the transactions carried out by individuals in managerial positions. Additionally, BAT announced a price adjustment for its core cigarette products effective 21 November, a move designed to align retail prices with the recently increased domestic excise duties.

1. Share‑Buyback and Management Purchases

BAT’s decision to acquire a substantial block of its own shares is consistent with a broader trend among mature consumer‑goods firms seeking to return value to shareholders when cash flow remains robust and capital allocation options are limited. The transaction, conducted through a prominent investment bank, demonstrates the company’s willingness to leverage financial intermediaries to execute large‑scale buybacks efficiently.

Management’s simultaneous purchase of shares signals confidence in BAT’s long‑term prospects. However, the dual nature of the transaction—both corporate and managerial—raises potential regulatory scrutiny under the UK’s market‑conduct rules, which require disclosure of any transactions that might influence share price. The regulatory filing released on the same day confirms compliance, yet the timing suggests an attempt to mitigate adverse market perception during a period of broader equity weakness.

From a financial‑analysis perspective, the buyback reduces the number of shares outstanding, potentially boosting earnings‑per‑share (EPS) and return on equity (ROE). Current analyst models project a modest EPS uplift of 2–3 % in the next fiscal year, assuming the share price remains within the observed 12‑month band. Nevertheless, the incremental benefit is tempered by BAT’s heavy exposure to regulated markets and the potential for future tax increases.

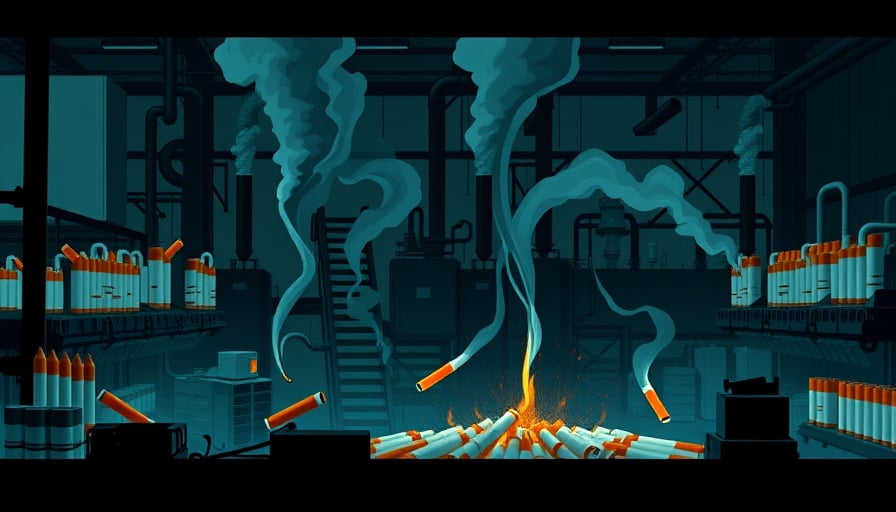

2. Price Adjustment in Response to Excise Duty Increase

BAT’s announcement of a 21 November price adjustment reflects the UK government’s decision to raise domestic excise duties on tobacco products. The company’s management has explicitly acknowledged that price hikes historically contribute to growth in illicit trade—a phenomenon observed in other high‑tax markets such as Sweden and Norway. By aligning retail prices with the updated tax framework, BAT aims to preserve gross margins while mitigating the risk of increased illicit competition.

The underlying business fundamentals suggest that BAT’s extensive distribution network and brand portfolio may cushion the impact of price increases. However, recent studies indicate that higher prices can reduce consumer elasticity more sharply in lower‑income segments, potentially eroding market share in emerging markets where BAT operates a significant portion of its revenue. Market‑research firms estimate a 0.4 % decline in volume sales in the United Kingdom over the next six months, offsetting a 0.8 % gain in average selling price.

From a regulatory perspective, the price adjustment is compliant with the UK’s Health Act and the Office of the Chief Cashier’s guidelines. Yet the announcement may still trigger investigations into whether BAT’s pricing strategy inadvertently supports illicit trade channels. This risk is amplified by BAT’s ongoing investments in e‑cigarettes and nicotine‑replacement products, where price‑elasticity dynamics differ markedly from traditional cigarettes.

3. Impact on Equity Indices and Share Price Volatility

The broader decline in European equity indices—STOXX 50 and FTSE 100—during the trading session has placed additional downward pressure on BAT’s share price. Although BAT’s price has remained within its 12‑month trading range, the combination of share buyback, management purchases, and the forthcoming price revision has contributed to a modest 1.5 % intraday move.

Analysts note that BAT’s valuation multiples—P/E of 12.3 and EV/EBITDA of 6.8—are currently near the median for the tobacco sector. The share price’s relative stability may suggest that market participants view BAT’s actions as incremental rather than transformational. Nevertheless, the convergence of regulatory change, pricing strategy, and shareholder activity warrants close monitoring.

4. Potential Risks and Opportunities

| Risk | Analysis |

|---|---|

| Illicit Trade | Price hikes may accelerate the shift to illicit markets. BAT’s distribution network may not fully counterbalance this effect. |

| Regulatory Scrutiny | Dual share‑buyback and management purchases could invite investigations under the UK Financial Conduct Authority’s market‑conduct rules. |

| Currency Exposure | BAT’s revenue is heavily weighted in the UK pound; a strengthening sterling may compress global earnings. |

| Opportunity | Analysis |

|---|---|

| Margin Enhancement | Aligning retail prices with excise duty increases could improve gross margins if illicit trade does not fully offset volume losses. |

| Shareholder Value | Buybacks reduce dilution and potentially increase EPS, providing a basis for future dividend hikes. |

| Diversification | Expanding the portfolio into regulated vaping and nicotine‑replacement products may mitigate revenue concentration in cigarettes. |

5. Conclusion

BAT’s recent corporate actions underscore the company’s efforts to navigate a challenging regulatory environment while maintaining shareholder value. The buyback and management purchases reinforce confidence in the firm’s fundamentals, yet they also introduce potential compliance and market‑conduct risks. The forthcoming price adjustment, necessitated by excise duty increases, reflects an attempt to sustain profitability amid heightened regulatory pressure but may also exacerbate illicit trade dynamics. Investors and analysts should weigh these factors against BAT’s historical resilience and strategic diversification plans to assess the long‑term implications for the company’s valuation and risk profile.