Corporate Analysis: Atmos Energy Corp. (NYSE: ATMO)

Atmos Energy Corp., a Dallas‑based natural‑gas utility, closed the week with a modest rise in share price relative to the same period a year earlier. Market analysts interpret the uptick as evidence of a gradual, yet sustained, improvement in investor confidence. A recent assessment by Mizuho Financial Group emphasized that the firm’s operational strengths—particularly its focus on natural‑gas marketing, procurement, and asset management—continue to underpin its valuation. No significant corporate actions, earnings releases, or regulatory filings were reported during the period, and the company remains listed on the New York Stock Exchange as part of the utilities sector.

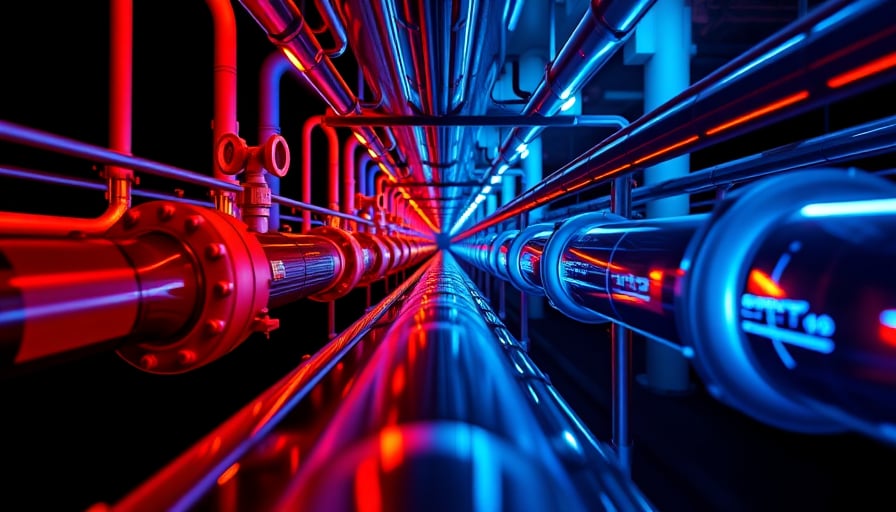

Technical Perspective on Atmos Energy’s Business Model

Although Atmos Energy’s core activities revolve around natural‑gas distribution, the company’s operations intersect with the broader electricity transmission and distribution framework in several key ways:

| Aspect | Relevance to Power Systems | Implications for Grid Stability |

|---|---|---|

| Natural‑gas procurement | Supports power‑generation units that rely on gas turbines, ensuring a stable fuel supply for peaking plants. | Reduces fuel-price volatility in the gas‑fired generation mix, contributing to ancillary‑services reliability. |

| Gas pipeline integrity and asset management | Maintains pressure and flow levels essential for gas‑to‑electricity conversions. | Minimizes the likelihood of gas supply interruptions that could cascade into power‑grid instability. |

| Market participation and hedging | Engages in futures and options to lock in gas prices, aligning with the risk‑management practices of grid operators. | Enhances predictability of operating costs, allowing better coordination with renewable intermittency management. |

| Infrastructure investment | Requires upgrades to pipelines and storage to accommodate fluctuating demand and potential future biogas or hydrogen integration. | Improves resilience of the overall energy system, supporting seamless transition to renewable sources. |

Grid Stability and Renewable Energy Integration

The integration of renewable resources such as wind and solar introduces variability that must be balanced by dispatchable generation or advanced grid‑management technologies. In this context, Atmos Energy’s natural‑gas assets can serve as a flexible backup:

- Rapid Ramp‑Up Capability: Gas turbines can be dispatched within minutes, smoothing the frequency and voltage fluctuations caused by renewable intermittency.

- Capacity Factor Optimization: By operating at lower, steady loads during peak renewable output, the firm can reduce wear and extend turbine lifespan, translating to lower lifecycle costs.

- Demand Response Support: The company can coordinate with utilities to curtail gas consumption during periods of high renewable penetration, aiding in maintaining grid balance.

Infrastructure Investment Requirements

To maintain grid stability while accommodating higher shares of renewables, several capital expenditures are warranted:

- Gas Pipeline Enhancements: Increasing diameter capacity and adding storage facilities to meet the variable demand for gas‑fired generation.

- Control System Modernization: Deploying advanced SCADA and predictive analytics for real‑time monitoring of pipeline pressure and flow.

- Hybrid Conversion Facilities: Investing in combined heat and power (CHP) plants that can switch between natural‑gas and biogas or hydrogen fuel sources, enhancing flexibility.

- Smart Metering and Demand‑Side Management: Expanding metering infrastructure to enable fine‑grained consumption data, supporting dynamic pricing and grid load shifting.

Regulatory Frameworks and Rate Structures

Utility regulation in the United States is primarily state‑level, with the Federal Energy Regulatory Commission (FERC) overseeing interstate transmission and wholesale markets. Key regulatory considerations for Atmos Energy include:

- Rate Design: The firm’s rates are structured around cost‑of‑service models that incorporate capital recovery, operating costs, and a reasonable rate of return. Changes in natural‑gas prices directly affect the cost component of these rates.

- Renewable Integration Mandates: Many states require utilities to achieve a certain percentage of renewable energy in their portfolio. While Atmos Energy is a gas provider, its ability to supply gas for renewable‑based power plants can influence the utility’s renewable portfolio standards compliance.

- Environmental Compliance: Stricter emissions standards for gas-fired power plants may necessitate the adoption of carbon capture technologies or fuel switching, impacting investment decisions and rate structures.

Economic Impacts of Utility Modernization

- Capital Expenditure (CapEx): Modernization projects can be capital intensive; however, they often yield long‑term cost savings through improved efficiency and reduced maintenance.

- Operating Expenditure (OpEx): Enhanced automation and predictive maintenance lower labor and fuel costs over time.

- Consumer Costs: While CapEx may lead to short‑term rate increases, the improved reliability and potential integration of lower‑cost renewable sources can ultimately moderate consumer energy costs.

- Job Creation: Infrastructure upgrades stimulate employment in construction, engineering, and maintenance sectors.

Conclusion

Atmos Energy Corp.’s modest share‑price appreciation reflects market confidence in its disciplined natural‑gas operations and its alignment with the evolving energy landscape. From a technical standpoint, the company’s assets provide critical flexibility that underpins grid stability as the United States continues to increase renewable penetration. Continued investment in pipeline infrastructure, smart‑grid technologies, and hybrid generation solutions will be essential to sustain this role. Regulatory frameworks, rate design, and the economic implications of modernization collectively shape the company’s future trajectory, balancing investor expectations with the broader societal shift toward a more resilient, low‑carbon energy system.