ASML Holding NV Sees Stock Price Surge Amid Growing Investor Confidence

In a move that’s sending shockwaves through the semiconductor manufacturing equipment market, ASML Holding NV has seen its stock price experience a moderate increase in recent days. The Dutch company’s shares have risen by a small percentage, indicating growing investor confidence in the company’s financial performance and market position.

At the heart of ASML’s success lies its commitment to shareholder returns. The company’s steady share buyback program has seen a substantial increase in purchase price, demonstrating its dedication to rewarding investors. This move has not gone unnoticed, with Warren Buffett’s Patient Investor model taking notice of ASML’s strong reputation among investors.

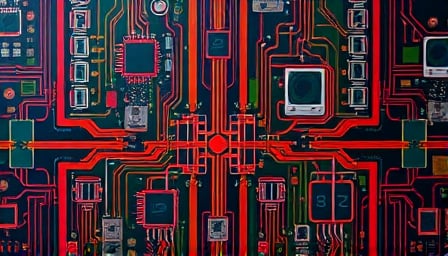

ASML’s dominance in the field of lithography technology, particularly in the development of EUV machines, has created a new monopoly in the industry. This has led to increased market value and a strong reputation among investors, who are increasingly optimistic about the company’s future prospects.

Key Drivers of ASML’s Success

- Steady share buyback program with increasing purchase price

- Dominance in lithography technology, particularly EUV machines

- Strong reputation among investors, including Warren Buffett’s Patient Investor model

- Growing investor confidence in the company’s financial performance and market position

What’s Next for ASML?

As the company continues to ride a wave of optimism, investors are eagerly awaiting its next move. With a strong track record of financial performance and a growing reputation among investors, ASML is well-positioned to continue its upward trajectory. Whether it’s through further investments in research and development or continued expansion into new markets, one thing is clear: ASML Holding NV is a company to watch in the world of semiconductor manufacturing equipment.