Antofagasta PLC: A Mining Giant in Turbulent Times

Antofagasta PLC, a stalwart of the London Stock Exchange, has been navigating treacherous waters in recent times. The company’s stock price has been on a wild ride, with periods of meteoric growth followed by precipitous drops. Market trends and industry developments have been the primary drivers of these fluctuations, but one thing remains clear: Antofagasta is a force to be reckoned with in the mining sector.

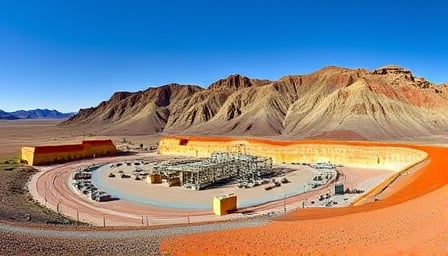

The company’s operations in Chile and Peru have cemented its position as a major player in the industry. Copper mining and exploration activities have been the backbone of Antofagasta’s success, with the company consistently delivering on its promise of growth and stability. However, the question remains: can Antofagasta weather the storm of market volatility and emerge stronger than ever?

- Key Factors Influencing Antofagasta’s Stock Price:

- Market trends and industry developments

- Global economic conditions

- Competition from rival mining companies

- Exploration and production costs

- Antofagasta’s Strengths:

- Diversified operations in Chile and Peru

- Focus on copper mining and exploration activities

- Experienced management team with a proven track record

- Strong financials and cash reserves

- The Road Ahead:

- Will Antofagasta’s focus on copper mining and exploration activities pay off in the long run?

- Can the company navigate market volatility and maintain its position as a major player in the mining sector?

- What are the implications of Antofagasta’s operations in Chile and Peru for the company’s future prospects?