Market Watch: Anheuser-Busch InBev’s Stable Performance Masks Limited Growth Potential

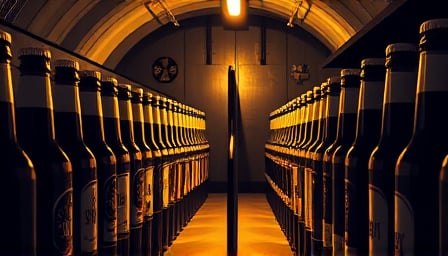

Anheuser-Busch InBev’s stock price has remained remarkably resilient, consistently trading near its 52-week high. This stability is a testament to the company’s entrenched position as a leading player in the global brewing industry, with a market capitalization that reflects its significant scale and influence.

However, a closer examination of the company’s historical performance reveals a more nuanced picture. A recent analysis suggests that investing in Anheuser-Busch InBev three years ago would have resulted in a minimal loss, with the stock price decreasing by less than 1% over that period. While this stability is certainly a positive attribute, it may not be enough to justify investment for those seeking significant returns.

Key Takeaways:

- Anheuser-Busch InBev’s stock price has remained stable, trading near its 52-week high

- The company’s market capitalization reflects its significant scale and influence in the global brewing industry

- A recent analysis suggests that investing in the company three years ago would have resulted in a minimal loss

- The company’s stable performance may not be enough to justify investment for those seeking significant returns

Forward-Looking Perspective: As the global brewing industry continues to evolve, Anheuser-Busch InBev will need to adapt and innovate to maintain its market position. While the company’s stable performance is a positive attribute, it may not be enough to drive significant growth and returns for investors. As such, investors may want to consider other opportunities that offer more compelling growth prospects.