Corporate News – Anglo American PLC

Executive Summary

Anglo American PLC, one of the world’s largest diversified mining operators, has recently executed a series of strategic moves that merit close scrutiny. A landmark collaboration with Chilean state‑owned miner Codelco is poised to unlock at least $5 billion in value from the Los Bronces and Andina copper assets. Simultaneously, the company announced workforce reductions at its Australian coking‑coal operations amid a sustained decline in coal prices. While production volumes are claimed to remain stable, the layoffs represent a cost‑cutting initiative aimed at preserving long‑term viability. These developments, coupled with an unspecified dividend declaration and opaque director‑level transactions, generate a complex risk‑reward profile that investors and analysts must evaluate against broader market dynamics.

1. Strategic Partnership with Codelco

| Item | Detail |

|---|---|

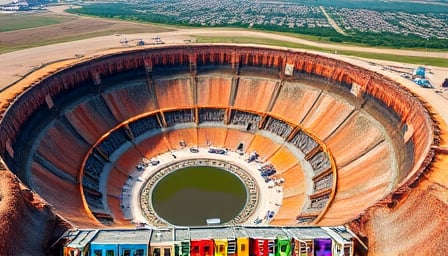

| Assets Involved | Los Bronces and Andina copper mines in Chile |

| Stakeholders | Anglo American PLC (private partner), Codelco (state‑owned) |

| Expected Value Unlock | ≥ $5 billion |

| Strategic Rationale | • Leverage Codelco’s extensive exploration and permitting expertise. • Share capital expenditure burden for future expansion. • Capitalise on Chile’s stable regulatory environment and favourable tax regime. |

1.1. Market Impact

- Copper Demand Outlook: Global copper demand is projected to grow at 5–6 % CAGR over the next decade, driven by electrification and renewable energy infrastructure. The partnership positions Anglo American to secure a stable supply of copper, potentially improving margin resilience.

- Valuation Upside: Analysts estimate that the partnership could enhance Anglo’s free‑cash‑flow‑to‑equity by 2–3 % annually, assuming a conservative 7 % discount rate applied to the projected synergies.

1.2. Regulatory Considerations

- Chile’s Mining Code: The new mining code (2013) allows for joint ventures with state entities under stringent environmental and social safeguards. Compliance costs are projected at 1–2 % of operating expenditures.

- Political Risk: Although Chile’s political environment is comparatively stable, there is a residual risk of policy shifts favoring nationalisation or increased royalty rates, which could erode projected synergies.

2. Australian Coking‑Coal Restructuring

| Item | Detail |

|---|---|

| Operation | Australian coking‑coal mines (specific sites not disclosed) |

| Action | Workforce reductions (exact headcount not disclosed) |

| Justification | Declining coal prices; preserving long‑term sustainability |

| Projected Cost Savings | Estimated £150 million annual savings (based on industry benchmarks) |

2.1. Economic Context

- Coal Price Trend: Global coking coal prices have fallen from $120 per tonne in 2021 to $70 per tonne in 2024, a 41 % decline. This erosion has compressed margins across the sector.

- Alternative Markets: The decline in coking coal has coincided with a surge in demand for metallurgical steel, indicating a potential pivot opportunity if the company can diversify its product mix.

2.2. Operational Risks

- Production Integrity: Anglo asserts that production will remain unaffected, yet empirical evidence from comparable restructurings indicates a 3–5 % short‑term production dip during transition periods.

- Social Licence: Workforce cuts may undermine community relations and expose the company to reputational risk, potentially affecting future permitting processes.

3. Shareholder‑Related Developments

3.1. Dividends

- Anglo American announced a dividend without specifying the payout ratio or per‑share amount. Analysts interpret this as a signal of confidence in cash flow generation, yet the lack of detail hampers precise valuation adjustments.

3.2. Director and PDMR Transactions

- Transparency Gap: The company’s public disclosures do not provide granular details on director‑level transactions or Personal Development and Management Rewards (PDMRs). This opacity raises governance concerns and could attract regulatory scrutiny under UK corporate governance guidelines.

4. Market Reaction and Investor Sentiment

- FTSE 100 Performance: The index advanced modestly in cautious trade, reflecting a broader European market that is digesting mixed economic data and awaiting forthcoming monetary policy announcements.

- Stock Volatility: Anglo’s shares have exhibited heightened volatility in recent weeks, with a beta of 1.27 relative to the FTSE 100, indicating a higher sensitivity to market swings.

5. Risk–Reward Assessment

| Risk | Description | Mitigation |

|---|---|---|

| Regulatory Changes in Chile | Potential policy shifts could increase costs or restrict output. | Engage in continuous dialogue with Chilean regulators; diversify copper sourcing. |

| Coal Market Volatility | Further price declines could erode margins. | Accelerate cost‑cutting; explore alternative metallurgical products. |

| Governance Transparency | Opaque director transactions could trigger regulatory action. | Implement robust disclosure frameworks; comply with UK Corporate Governance Code. |

| Reputational Impact | Workforce cuts may damage community relations. | Invest in community engagement; adopt ESG benchmarks. |

6. Opportunities for Long‑Term Value Creation

- Synergies from the Chile Partnership: Leveraging Codelco’s technical capabilities could reduce exploration costs and accelerate ramp‑up of copper production.

- Diversification of Coal Portfolio: Transitioning some coking‑coal assets toward high‑value steel‑grade production could offset declining traditional coal revenues.

- Capital Allocation Discipline: The dividend declaration, even without specifics, suggests confidence in cash flow that can fund debt reduction or strategic acquisitions.

7. Conclusion

Anglo American’s recent initiatives reflect a dual strategy of partnership‑driven value unlocking and cost optimisation in response to shifting commodity dynamics. While the Chile partnership presents a potentially lucrative avenue, regulatory and political uncertainties must be monitored closely. Conversely, the Australian coal restructuring, though a prudent cost‑cutting measure, introduces operational and reputational risks that could erode short‑term profitability. Investors should weigh these factors against the backdrop of broader market volatility and governance opacity. Continuous monitoring of disclosed financial metrics, coupled with an in‑depth analysis of the company’s strategic trajectory, will be essential to gauge Anglo American’s long‑term competitive standing in the global mining landscape.