Corporate Outlook: Analyst Adjustments and Technological Context for Analog Devices Inc.

Analog Devices Inc. (ADI) has recently attracted renewed attention from several coverage firms, all of whom have nudged their price targets upward or maintained a positive stance. Truist Financial raised its target to $291 from $258, implying a potential upside of just over six percent based on current trading levels. Earlier in the month, Robert W. Baird increased its objective to $275 from $250, while Weiss Ratings retained its “buy” recommendation. BNP Paribas Exane, a new entrant to the coverage universe, set a target of $300 and issued an “outperform” rating. JPMorgan’s update, although truncated in the source, indicated a favorable outlook. The stock remains within a range that reflects the company’s robust presence across a broad spectrum of technology sectors, with its share price positioned below its most recent 52‑week high.

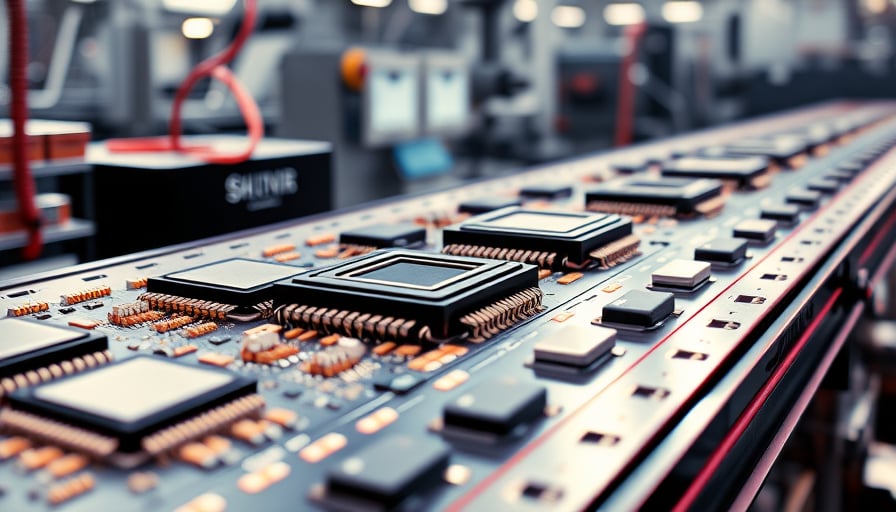

1. Semiconductor Technology Trends and Node Progression

The semiconductor industry continues to push the envelope toward finer process nodes. While leading-edge 7‑nm and 5‑nm nodes dominate the high‑performance computing (HPC) and mobile markets, Analog Devices’ core offerings reside largely in the 28‑nm to 14‑nm space, where analog, RF, and mixed‑signal designs retain competitive advantages. The company’s portfolio—comprising precision analog, power management, and signal processing solutions—has benefited from incremental node improvements that enhance power efficiency and noise performance without necessitating a full transition to EUV lithography.

Recent advancements in directed self‑assembly (DSA) and high‑NA EUV lithography have enabled tighter critical dimension control and improved line‑edge roughness, which are essential for the analog front‑ends that rely on meticulous matching of transistors and capacitors. Analog Devices has leveraged these lithographic innovations to maintain high yield on 14‑nm processes, where the trade‑off between manufacturability and performance is most pronounced.

2. Manufacturing Processes and Yield Optimization

Yield optimization remains a critical lever for companies like ADI, which operate in a niche but highly specialized segment. Key strategies include:

| Yield Lever | Description | Impact on Analog Devices |

|---|---|---|

| Process Variability Control | Tightening statistical process control (SPC) metrics for line width and thickness. | Improves matching in differential pairs, reducing offset and gain error. |

| Defect Density Reduction | Deployment of advanced metrology (e.g., SEM‑IL, EBL) to detect sub‑10 nm defects. | Lowers failure rates in high‑density memory‑controlled analog circuits. |

| Design‑For‑Manufacturability (DFM) | Incorporating guard rings, well‑sub‑strate isolation, and layout‑directed routing. | Enhances robustness against substrate coupling and latch‑up in mixed‑signal designs. |

| Test‑Driven Yield | Early wafer‑level testing to isolate defective dies before packaging. | Cuts downstream packaging costs and increases overall yield. |

Analog Devices has invested heavily in DFM and early test programs, which are reflected in its ability to maintain competitive cost structures despite the inherent complexity of analog circuitry.

3. Technical Challenges in Advanced Chip Production

As foundries push toward 7‑nm and beyond, several technical challenges emerge:

- High‑K/Metal‑4 (HKM4) Gate Dielectrics – Reducing gate leakage while preserving high capacitance is essential for analog gain stages.

- EUV Lithography Defectivity – EUV introduces new defect mechanisms (e.g., particulate contamination, mask‑induced errors) that require sophisticated defect‑mapping techniques.

- Sub‑Threshold Swing Management – In low‑power analog circuits, controlling sub‑threshold leakage without compromising speed is a balancing act.

ADI’s focus on mature nodes mitigates some of these challenges, yet the company must remain agile to adopt new lithographic tools (e.g., high‑NA EUV) when they become economically viable for analog processes.

4. Capital Equipment Cycles and Foundry Capacity Utilization

Foundries operate on long capital equipment cycles, often spanning 3–5 years from planning to full deployment. Key equipment includes:

- EUV steppers (e.g., ASML TWIN‑V, TWIN‑B) for 7‑nm nodes.

- High‑NA EUV for 5‑nm and sub‑5‑nm nodes.

- Advanced metrology suites (e.g., SEM‑IL, 3‑D metrology) for defect detection.

Foundry capacity utilization directly influences lead times and cost structures. During periods of high utilization, foundries may prioritize high‑volume clients, potentially delaying access for specialized firms like ADI. Conversely, lower utilization can enable foundries to offer more flexible pricing and earlier access to newer tools. ADI’s strategy of partnering with multiple foundries (TSMC, GlobalFoundries, UMC) helps buffer against capacity constraints and allows the company to negotiate favorable terms on advanced process nodes.

5. Interplay Between Design Complexity and Manufacturing Capabilities

Advanced analog designs increasingly rely on complex mixed‑signal architectures, high‑density interconnects, and precise voltage regulation. These design demands stress manufacturing capabilities in several ways:

- Design for Yield – More intricate layouts raise the probability of defects; thus, design teams must incorporate redundancy and error‑correcting features.

- Process Margining – Analog performance is highly sensitive to process variations; therefore, tighter process windows and more accurate calibration procedures are essential.

- Packaging Constraints – High pin counts and low inductance requirements push packaging solutions toward advanced 3‑D or flip‑chip technologies, necessitating close collaboration with packaging fabs.

Analog Devices’ success in navigating these challenges is evidenced by its strong presence across automotive, industrial, medical, and telecommunications markets—sectors that demand high reliability and low failure rates.

6. Semiconductor Innovation as an Enabler for Broader Technology Advances

Semiconductor advances drive progress across a multitude of domains:

| Domain | Enabling Technology | Impact |

|---|---|---|

| Internet of Things (IoT) | Low‑power analog front‑ends, RF transceivers | Enables battery‑operated sensors and edge intelligence. |

| Artificial Intelligence (AI) | Precision ADCs, DSP cores | Provides high‑throughput data ingestion for machine learning pipelines. |

| Automotive | Power management ICs, radar signal processors | Enhances vehicle safety and autonomous driving capabilities. |

| Medical Devices | Bi‑passive sensors, signal amplifiers | Improves diagnostic accuracy and patient monitoring. |

Analog Devices’ portfolio aligns closely with these trends, positioning the company to benefit from the sustained demand for high‑quality analog and mixed‑signal solutions. As the industry moves forward, the ability to deliver reliable, high‑performance silicon will remain a key differentiator, justifying the upward revisions in analyst price targets reflected in recent coverage.

This article synthesizes current analyst perspectives with an in‑depth technical review of semiconductor manufacturing dynamics, offering a comprehensive view of Analog Devices’ strategic position within the broader industry ecosystem.