Analog Devices Inc. Fortifies Its Position as a Strategic Enabler of AI and Industry 4.0

Introduction

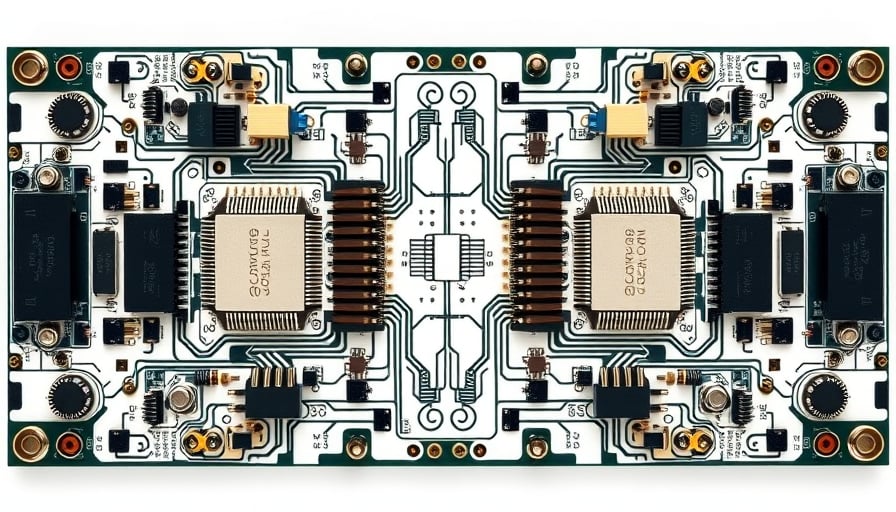

The semiconductor ecosystem is witnessing a decisive shift toward data‑centric, connected, and autonomous systems. In this context, Analog Devices Inc. (ADI) has carved out a distinct niche as a supplier of high‑performance integrated circuits (ICs) that underpin the emerging Artificial‑Intelligence (AI) and Industry 4.0 landscapes. While the company’s portfolio spans communications, automotive, aerospace, and industrial instrumentation, its recent performance signals a broader trend: analog and mixed‑signal solutions are becoming foundational to the next generation of digital technologies.

1. Market Dynamics Driving Demand for Analog Innovation

| Sector | Growth Drivers | Analog Requirement |

|---|---|---|

| Artificial‑Intelligence | Edge computing, real‑time inference, low‑power data acquisition | High‑resolution analog front‑ends, ADCs, sensor‑to‑signal conversion |

| Industry 4.0 | Factory‑automation, IoT, predictive maintenance | Robust signal conditioning, real‑time control ICs, high‑speed data converters |

| Automotive | Advanced Driver‑Assistance Systems (ADAS), autonomous driving | High‑precision sensing, sensor fusion, power‑efficient signal paths |

| Aerospace & Defense | High‑reliability, extreme environments | Radiation‑hardened, low‑noise, high‑bandwidth ICs |

The table illustrates that the growth curves for AI and Industry 4.0 are outpacing many traditional semiconductor segments. As these sectors mature, the demand for analog precision and mixed‑signal reliability rises in tandem. ADI’s core competencies align perfectly with this trajectory, positioning it as a natural partner for companies seeking to accelerate product development cycles while maintaining stringent performance standards.

2. Analog Devices’ Strategic Response

2.1 Portfolio Expansion

ADI has intensified its focus on high‑bandwidth analog and mixed‑signal solutions, including:

- Ultra‑Low‑Noise Amplifiers: Enabling higher fidelity data capture for AI inference pipelines.

- High‑Speed ADCs: Supporting real‑time video, LiDAR, and radar processing in autonomous vehicles.

- Robust Signal Conditioning ICs: Delivering precision in harsh industrial and aerospace environments.

2.2 Ecosystem Partnerships

Collaborations with AI hardware vendors and system integrators allow ADI to embed its ICs early in the product development lifecycle. These alliances reduce time‑to‑market for AI‑enabled devices and embed Analog Devices’ solutions into critical supply chains.

2.3 Research & Development Investment

A significant portion of ADI’s R&D budget is allocated to emerging areas such as neuromorphic computing and quantum‑aware interfaces, ensuring the company remains at the cutting edge of future silicon architectures.

3. Challenging Conventional Wisdom

Traditionally, the semiconductor narrative has focused on digital logic, with analog components treated as supporting infrastructure. ADI’s ascendancy challenges this view:

- Analog as a Competitive Edge: In AI workloads, the energy efficiency of analog front‑ends can reduce overall system power consumption by 30–40 %, a decisive factor for edge deployments.

- Reliability Imperative: The robustness of analog ICs is critical in industrial settings where digital error rates can be intolerable.

- Integration of Mixed‑Signal and Digital: Companies that blend analog precision with digital flexibility gain a product differentiation advantage, a trend that ADI exploits by offering fully integrated mixed‑signal platforms.

4. Broader Implications for the Technology Ecosystem

Supply Chain Resilience ADI’s diversified customer base across sectors buffers it against cyclical downturns that may affect any single industry, fostering stability in the supply chain.

Catalyst for Innovation By providing high‑performance analog blocks, ADI enables other firms to focus on higher‑level AI algorithms and system design, accelerating overall innovation.

Shift Toward Hybrid Silicon The convergence of analog and digital domains signals a move toward hybrid silicon solutions—an area where ADI’s expertise gives it a first‑mover advantage.

5. Forward‑Looking Analysis

- Near Term (1–2 years): ADI is expected to capture larger market shares in automotive AI and industrial IoT, driven by regulatory mandates for safer, more connected systems.

- Mid Term (3–5 years): As edge AI becomes ubiquitous, demand for low‑power, high‑bandwidth analog converters will surge, amplifying ADI’s growth trajectory.

- Long Term (5+ years): Emerging paradigms such as neuromorphic computing may redefine the role of analog circuits, potentially positioning ADI at the forefront of next‑generation silicon that mimics biological neural processing.

Conclusion

Analog Devices Inc. is not merely a passive supplier; it is actively shaping the architecture of AI and Industry 4.0 ecosystems. By aligning its product development with the evolving demands of high‑growth sectors, the company demonstrates how analog innovation can drive digital transformation. For investors, partners, and competitors alike, ADI’s trajectory offers a compelling case study in leveraging legacy strengths to seize future opportunities.