Analog Devices Inc: A Resilient Player in a Volatile Market

As the global semiconductor landscape continues to evolve, Analog Devices Inc has demonstrated a remarkable ability to navigate the complexities of a rapidly changing industry. Despite experiencing fluctuations in stock price over the past year, the company’s underlying fundamentals remain strong, with Wall Street analysts predicting a bright future for this industry stalwart.

Market Performance: A Mixed Bag

While Analog Devices’ stock price has advanced, it has underperformed the market as a whole. Investors who entered the market at higher price points may have faced significant losses, a testament to the unpredictable nature of the semiconductor sector. However, this volatility has also created opportunities for savvy investors to acquire shares at discounted prices.

Safe-Haven Investment in a Recessionary Environment

In the face of economic uncertainty, Wall Street analysts are increasingly turning to Analog Devices as a potential safe-haven investment. Firms such as Citi have recommended the stock as a prudent choice for investors seeking to mitigate potential losses in the event of a recession. This endorsement is a testament to the company’s ability to adapt and thrive in a rapidly changing economic landscape.

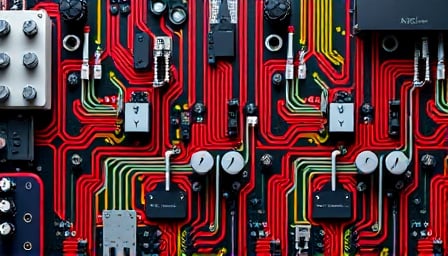

Manufacturing Strategy: A Key Differentiator

One of the key factors contributing to Analog Devices’ resilience is its ability to outsource manufacturing and avoid tariffs imposed by China. This strategic move has enabled the company to maintain a competitive edge in the market, even as trade tensions continue to escalate. By leveraging its global supply chain, Analog Devices has positioned itself for long-term success, even in the face of economic uncertainty.

Conclusion

As the semiconductor industry continues to evolve, Analog Devices Inc remains a compelling choice for investors seeking a resilient and adaptable player. With its ability to navigate the complexities of a rapidly changing market, the company is well-positioned to thrive in a variety of economic scenarios. As Wall Street analysts continue to monitor the company’s progress, one thing is clear: Analog Devices is a name to watch in the months and years ahead.