American Express Co Continues to Impress with Strategic Partnerships and Steady Growth

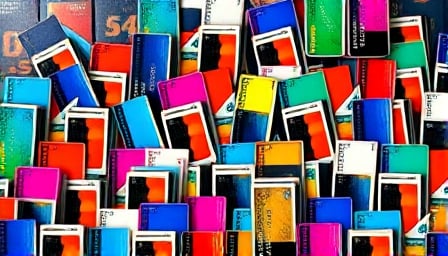

American Express Co has been making waves in the consumer finance sector with its innovative approach to enhancing services and forging meaningful partnerships. The company’s latest collaborations with high-profile sports and entertainment events, such as the US Open Tennis Championships and the Formula 1 Crypto.com Miami Grand Prix, are a testament to its commitment to delivering exclusive experiences and perks to its valued card members.

These strategic partnerships are expected to have a significant impact on the company’s reputation and customer engagement. By offering unique experiences and rewards, American Express Co is not only strengthening its relationships with existing customers but also attracting new ones. This approach is a key differentiator in a highly competitive market, setting the company apart from its peers.

On the financial front, American Express Co’s stock price has been relatively stable, with a slight increase from its 52-week low. While it has not yet reached its 52-week high, the company’s market capitalization remains substantial, and its price-to-earnings ratio is within a reasonable range. This stability is a reassuring sign for investors, indicating that the company is well-positioned to navigate the ever-changing market landscape.

Overall, American Express Co appears to be maintaining its position as a leading player in the consumer finance sector. With its commitment to innovation, customer satisfaction, and strategic partnerships, the company is poised to continue its growth trajectory and remain a dominant force in the industry.

Key Highlights:

- American Express Co has partnered with high-profile sports and entertainment events to offer exclusive experiences and perks to its card members

- The company’s strategic partnerships are expected to boost its reputation and customer engagement

- American Express Co’s stock price has been relatively stable, with a slight increase from its 52-week low

- The company’s market capitalization remains substantial, and its price-to-earnings ratio is within a reasonable range