Institutional Investor Activity and Strategic Infrastructure Modernization at Ameren Corporation

Ameren Corporation, the publicly traded utility holding company that delivers electricity and natural gas to customers in Missouri and Illinois, has recently attracted notable attention from institutional investors. In late January, a cluster of investment funds and advisory firms disclosed both purchases and divestitures of Ameren shares, underscoring the continuing relevance of the company within the utilities sector.

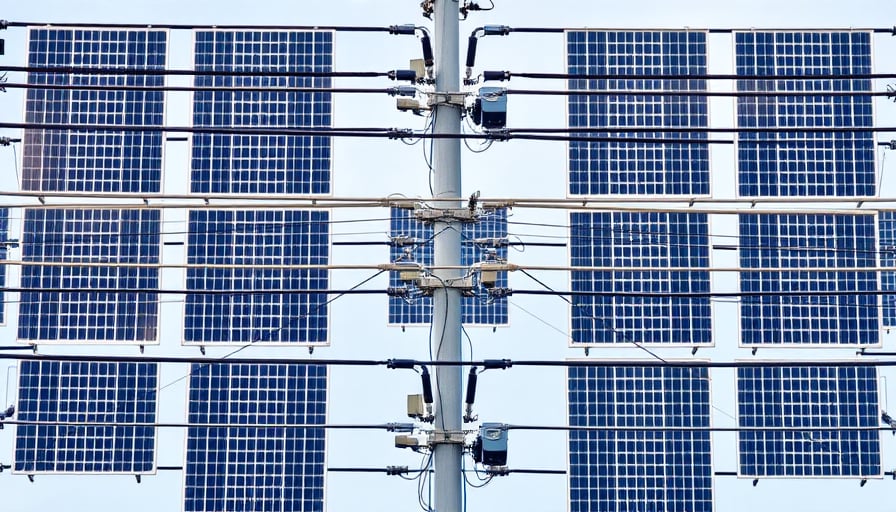

Simultaneously, Ameren announced a series of substantial upgrades to its transmission and distribution network across the Midwest. The upgrades will incorporate advanced digital technologies—such as smart grid sensors, automated fault detection systems, and real‑time data analytics—to improve reliability and operational efficiency. Moreover, the company reaffirmed its commitment to a climate‑neutral energy future by aligning the modernization plan with long‑term decarbonization objectives, including increased integration of renewable generation and enhanced grid resilience against extreme weather events.

Market Context and Sector Dynamics

Utility companies operate under a unique blend of regulatory oversight, steady revenue streams, and capital-intensive infrastructure requirements. The ongoing transition to low‑carbon power generation, coupled with heightened expectations for grid resilience, has intensified investment in digital and physical assets. Institutional investors increasingly evaluate utilities not only on dividend yield and regulatory risk but also on their capacity to adapt to technological disruptions and meet sustainability mandates.

Ameren’s focus on digital integration and climate neutrality positions it favorably relative to peers that have slower modernization trajectories. The company’s geographic footprint in the Midwest—a region experiencing rapid renewable expansion—further enhances its potential to capture new revenue streams from distributed energy resources and demand‑response programs.

Competitive Positioning

Within the broader utilities landscape, Ameren competes with a mix of regional and national incumbents, as well as newer entrants that leverage distributed energy systems. By upgrading its transmission and distribution grid, Ameren strengthens its ability to manage bi‑directional power flows, integrate higher levels of renewable generation, and reduce outage durations—all factors that can translate into improved customer satisfaction and regulatory favorability.

The strategic emphasis on digital technologies also aligns Ameren with the growing trend of “smart utilities,” which employ data‑driven decision‑making to lower operational costs and enhance asset lifecycle management. Firms that lag in adopting such capabilities risk higher maintenance costs and reduced competitiveness in an environment where regulatory agencies increasingly reward grid modernization and reliability.

Economic and Regulatory Considerations

The utility sector remains sensitive to macroeconomic conditions, particularly interest rates and capital‑market access, because large infrastructure projects require substantial debt financing. Ameren’s recent institutional investor activity suggests confidence in its ability to service debt while pursuing growth initiatives. Additionally, regulatory bodies in Missouri and Illinois have historically provided supportive frameworks for utilities that invest in grid modernization, often through rate‑base adjustments or accelerated depreciation schedules.

Climate‑neutral commitments also intersect with evolving policy landscapes. Federal and state incentives—such as renewable portfolio standards, carbon pricing mechanisms, and infrastructure investment funds—create financial advantages for utilities that proactively reduce greenhouse gas emissions. Ameren’s alignment with these trends positions it to benefit from potential subsidies or tax incentives tied to renewable integration and grid resilience.

Broader Economic Trends

The shift toward decarbonized energy and digital grid management reflects a global transformation in energy markets, driven by technological advancements, consumer expectations, and climate policy. Utilities that successfully integrate smart technologies and pursue renewable sources can capture new value propositions, including ancillary services in electric vehicle charging, energy storage, and microgrid operations.

Ameren’s dual focus on infrastructure modernization and climate neutrality exemplifies a strategic response to these macro trends. By modernizing its transmission network and embedding digital capabilities, the company not only enhances operational efficiency but also positions itself to leverage emerging revenue streams associated with the broader transition to a low‑carbon, digitalized electricity system.