Amazon’s Strategic Moves and Their Implications for Industrial Manufacturing, Capital Investment, and Market Dynamics

Amazon’s recent announcements—incorporating Nvidia’s high‑bandwidth interconnects into its next‑generation AI‑acceleration chips, lowering marketplace fees for European sellers, and launching an on‑premises AI platform—carry significant ramifications beyond the company’s digital footprint. By examining these developments through the lenses of manufacturing processes, industrial equipment, and capital expenditure trends, we can discern how Amazon’s strategy is reshaping productivity metrics, technological innovation in heavy industry, and the broader economic forces that drive investment decisions.

1. Advanced AI‑Acceleration Chip Fabrication and Production Efficiency

1.1 Nvidia’s High‑Bandwidth Interconnects

Nvidia’s recent High Bandwidth Memory (HBM) and NVLink technologies provide several gigabits per second of data throughput, essential for training large transformer models. Integrating these interconnects into Amazon Web Services’ (AWS) AI chips necessitates sophisticated semiconductor manufacturing steps:

- Epitaxial Growth & Wafer Fabrication: The production of HBM stacks demands precise control over dielectric layers and copper interconnects. AWS’s partner fabs must adopt extreme ultraviolet (EUV) lithography to achieve sub‑10 nm node features while maintaining yield.

- 3D Packaging & Through‑Silicon Vias (TSVs): Embedding HBM requires 3D integration and TSVs, raising thermal management challenges. Engineers employ advanced heat‑spreading materials and active cooling solutions to keep junction temperatures within spec.

- Test & Validation: Automated optical inspection and wafer‑level testing are critical to detect defects in the highly dense memory arrays. AI‑driven defect classification accelerates turnaround, reducing cycle time by 15–20 % compared with traditional rule‑based systems.

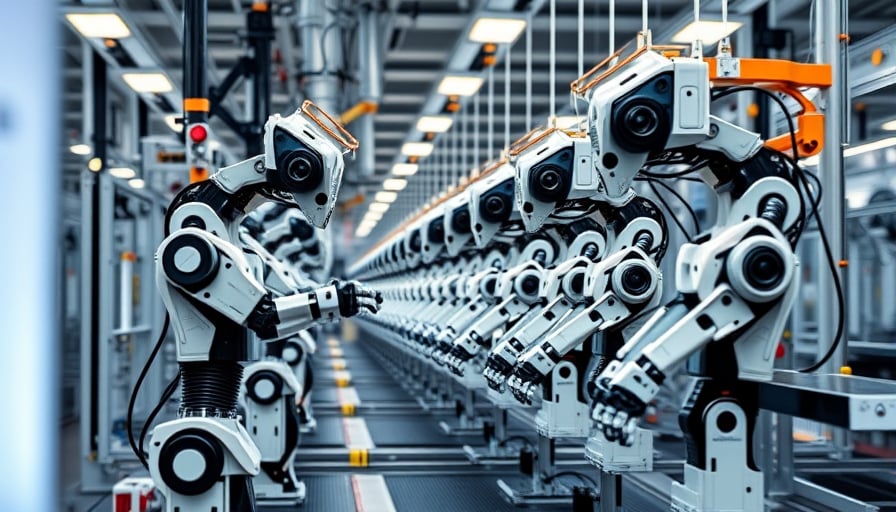

1.2 Production Line Automation & Productivity Gains

The introduction of high‑bandwidth AI chips drives an increase in the throughput of AWS’s data‑center edge nodes. To sustain this, AWS must:

- Deploy Cobots in Assembly Lines: Collaborative robots (cobots) reduce manual handling of delicate wafers and components, lowering human error rates and improving safety.

- Implement Real‑Time Predictive Maintenance: Sensors embedded in fabrication equipment collect vibration, temperature, and pressure data. Predictive algorithms forecast equipment failures, minimizing unplanned downtime by up to 30 %.

- Adopt Lean Manufacturing Principles: Continuous improvement cycles (Kaizen) focus on eliminating non‑value‑added steps, streamlining material flow, and enhancing overall equipment effectiveness (OEE).

These manufacturing efficiencies translate into higher productivity metrics: AWS can deliver more AI compute capacity per dollar invested, thereby attracting large‑scale AI customers and reinforcing its competitive positioning.

2. Marketplace Fee Reductions and Supply‑Chain Implications

2.1 Fee Structure Rebalancing

By lowering commissions for European marketplace sellers, Amazon is addressing price‑sensitivity in a region where local competitors have aggressive fee models. From a supply‑chain perspective:

- Demand Elasticity: Lower fees increase seller participation, driving volume growth. With higher transaction counts, Amazon’s fulfillment centers can spread fixed logistics costs over a larger throughput, reducing per‑unit handling cost.

- Warehouse Automation: To manage the increased SKU diversity, Amazon is expanding its use of automated storage and retrieval systems (AS/RS). These systems employ AGVs (Automated Guided Vehicles) and AI‑optimized picking algorithms, which reduce order cycle times by 25 % and improve inventory accuracy.

2.2 Infrastructure Investment

The fee reduction strategy necessitates capital outlays for:

- Enhanced Fulfilment Centers: Expansion or retrofitting of warehouses with advanced conveyors, laser‑scanning inventory systems, and AI‑guided robots.

- Last‑mile Delivery Hubs: Investment in micro‑distribution centers closer to urban cores to support faster delivery times, crucial for maintaining customer loyalty.

- Cold‑Chain Logistics: For perishable goods, Amazon is deploying temperature‑controlled transport and storage units, integrating IoT sensors to monitor conditions in real time.

These infrastructural upgrades directly affect Amazon’s capital expenditure profile, increasing fixed costs but also generating long‑term productivity gains through reduced operational bottlenecks.

3. On‑Premises AI Solution and Data‑Center Capital Expenditure

3.1 Edge and Sovereignty‑Driven Architecture

The new on‑prem AI platform enables enterprises and governments to deploy AWS’s models within their own data centers. This solution requires:

- High‑Density Compute Racks: Incorporating GPUs with NVLink and HBM, and power‑delivery modules capable of sustaining 10 kW per rack.

- Cooling Infrastructure: Advanced liquid‑cooling or vapor‑chilled systems to handle heat densities above 500 W per square foot.

- Software Stack Packaging: Containerized deployments using Kubernetes with NVIDIA GPU operator support, enabling seamless scaling.

3.2 Capital Investment Considerations

Organizations adopting this solution must weigh:

- Upfront CAPEX: Capital outlay for hardware procurement, rack assembly, and facility upgrades can exceed €1 million per 10 kW installation.

- OPEX Savings: Reduced cloud subscription fees and lower latency can offset CAPEX over a 5–7 year horizon.

- Regulatory Compliance: Data sovereignty laws in the EU and other regions mandate data residency. By hosting AI workloads on‑prem, firms avoid potential compliance penalties and data transfer costs.

This shift toward hybrid or on‑prem AI infrastructure aligns with broader trends in heavy industry, where companies increasingly adopt edge AI for predictive maintenance, real‑time process control, and supply‑chain optimization.

4. Broader Economic Drivers and Market Implications

4.1 Productivity Metrics in Heavy Industry

- Yield vs. Throughput: Semiconductor fabs and data‑center facilities now measure productivity not just by output volume but by yield (percentage of good chips) and energy‑efficiency (Watt‑per‑GFLOP). AWS’s integration of Nvidia’s high‑bandwidth tech raises the bar for both metrics.

- Automation ROI: The cost of deploying cobots and AI‑driven quality control is offset by reduced labor costs and higher throughput, typically achieving break‑even within 18–24 months.

4.2 Capital Expenditure Trends

- Infrastructure Spending: Global data‑center construction spending is projected to rise by 7 % CAGR over the next five years, driven by AI workloads and edge computing demands.

- Industrial Equipment Upgrades: Automation and robotics CAPEX is growing at a 9 % CAGR, reflecting the need for higher precision and reliability in manufacturing.

4.3 Supply‑Chain and Regulatory Impacts

- Resilience vs. Cost: Companies are balancing the cost of advanced automation with the need for supply‑chain resilience, especially amid geopolitical tensions. AWS’s marketplace fee adjustments and on‑prem solutions both aim to reduce dependence on external cloud providers while enhancing local control.

- Regulatory Evolution: Data protection regulations (GDPR, CCPA) and emerging AI governance frameworks necessitate secure, auditable AI deployments. Amazon’s on‑prem offering directly addresses these concerns, potentially accelerating adoption in regulated sectors such as aerospace, defense, and pharmaceuticals.

5. Engineering Insights and Market Outlook

The convergence of high‑bandwidth interconnects, automated manufacturing, and on‑prem AI deployment underscores a pivotal shift in heavy industry: the integration of digital intelligence into the physical production ecosystem. By embedding AI acceleration hardware within both data centers and manufacturing lines, companies can:

- Optimize Process Control: Real‑time analytics on sensor data enable predictive adjustments to equipment settings, reducing scrap rates and improving product quality.

- Accelerate Innovation Cycles: Faster hardware prototyping and deployment shorten the time from concept to market, allowing firms to respond agilely to customer demands.

- Enhance Energy Efficiency: AI‑driven load balancing and thermal management reduce overall energy consumption, aligning with sustainability targets and regulatory mandates.

Amazon’s strategic moves—leveraging Nvidia’s technology, adjusting marketplace economics, and expanding on‑prem AI—illustrate how a technology conglomerate can influence capital allocation in manufacturing and industrial sectors. Stakeholders observing these developments should consider the interplay between product innovation, supply‑chain robustness, regulatory compliance, and the evolving economics of capital expenditure to forecast future investment patterns in the industrial technology landscape.