Altria Group Inc.: Navigating a Stabilizing Yet Evolving Consumer Staples Landscape

Altria Group Inc. remains a cornerstone of the consumer‑staples sector, with its core operations anchored in the manufacturing and sales of cigarettes and tobacco products. Recent market activity indicates that the stock is trading within a familiar range, reflecting the company’s long‑standing valuation profile. Analysts note a narrowing earnings‑per‑share (EPS) outlook for 2025, suggesting that margin expansion may soon plateau. Nevertheless, the share price has displayed relative stability, signaling that investors are watching the company’s performance closely without experiencing significant volatility.

1. Demographic Shifts and the Evolving Tobacco Consumer

The tobacco industry is witnessing a pronounced demographic transition. Younger generations—particularly Millennials and Gen Z—continue to eschew traditional cigarettes in favor of perceived “healthier” alternatives such as vaping and nicotine pouches. This shift presents a dual challenge and opportunity for Altria:

- Opportunity: The company’s portfolio already includes the popular Vuse brand of electronic cigarettes. By expanding its e‑cigarette and nicotine‑delivery offerings, Altria can tap into the growing segment of consumers seeking lower‑risk alternatives.

- Challenge: The broader cultural movement toward wellness and anti‑smoking campaigns exerts pressure on cigarette sales, especially in markets with stringent advertising restrictions.

Altria’s recent call for action against illegal e‑cigarette sales underscores its commitment to regulatory compliance and public‑health responsibilities. This stance can be leveraged to build trust among health‑conscious consumers while maintaining brand integrity.

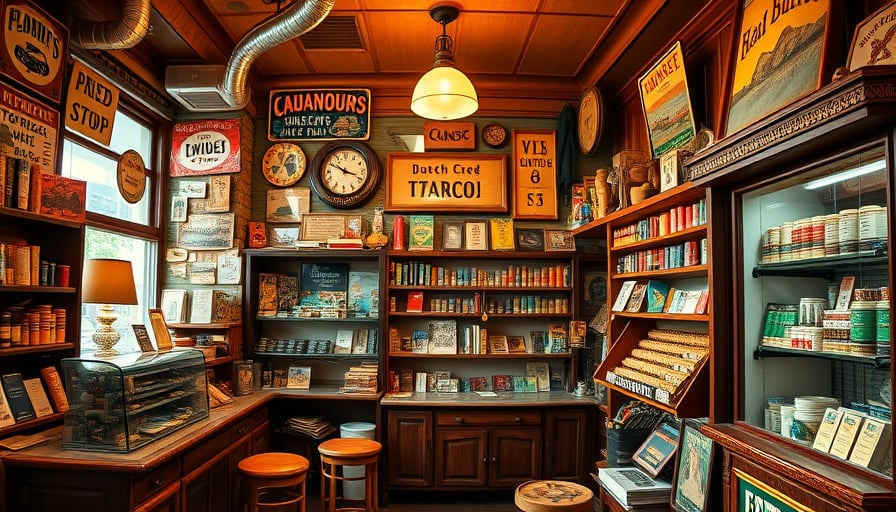

2. Digital Transformation Meets Physical Retail

The intersection of digital channels and physical retail continues to reshape the consumer staples landscape. Altria’s traditional distribution channels—corner stores, gas stations, and large retailers—remain vital. However, digital engagement offers new avenues for growth:

- Omnichannel Loyalty Programs: Integrating loyalty rewards across physical points of sale and mobile platforms can deepen customer engagement.

- Data‑Driven Inventory Management: Leveraging point‑of‑sale data to forecast demand enables more efficient stock replenishment, reducing waste and ensuring product availability.

- E‑Commerce Partnerships: Collaborations with e‑commerce giants for discreet, age‑verification‑enabled purchases can open revenue streams without compromising regulatory standards.

These digital initiatives must align with evolving consumer expectations for convenience, personalization, and transparency.

3. Generational Spending Patterns and Consumer Experiences

Generational spending patterns reveal divergent attitudes toward disposable income. While Baby Boomers and Gen X retain discretionary spending power, Millennials and Gen Z prioritize experiences over material goods and exhibit heightened sensitivity to brand purpose. Altria can capitalize on these trends by:

- Experiential Marketing: Curating events that highlight product heritage or sponsor wellness initiatives can resonate with value‑driven consumers.

- Social Responsibility Narratives: Transparent communication about efforts to curb illegal sales, support smoking cessation, and reduce environmental impact can differentiate the brand in a crowded market.

- Co‑Branding Opportunities: Partnering with lifestyle and wellness brands to create limited‑edition product lines could attract crossover audiences.

These strategies align with broader cultural movements that emphasize authenticity, sustainability, and social impact.

4. Forward‑Looking Market Opportunities

- Regulatory‑Driven Product Innovation: As governments tighten regulations on nicotine delivery, Altria has the capital and expertise to develop low‑nicotine or non‑nicotine alternatives, positioning itself as a leader in responsible innovation.

- Emerging Markets Expansion: Many developing economies still exhibit robust tobacco consumption. Strategic entry into these markets, coupled with localized digital marketing, could offset stagnation in mature markets.

- Health‑Tech Integration: Investing in digital cessation tools, such as mobile apps that track quit attempts or provide personalized support, can create new revenue streams while fulfilling corporate social responsibility mandates.

5. Investor Implications

The narrowing EPS outlook signals that Altria’s margin expansion is approaching a plateau, yet the company’s strategic focus on regulatory compliance and product diversification suggests a prudent path forward. Investors should monitor:

- Regulatory Outcomes: Any tightening of e‑cigarette restrictions could materially impact earnings.

- Digital Adoption Metrics: Adoption rates of omnichannel initiatives will serve as early indicators of future revenue growth.

- Consumer Sentiment Surveys: Tracking shifts in brand perception among key demographics will help gauge long‑term viability.

In summary, Altria Group Inc. stands at a crossroads where traditional staples intersect with digital innovation, shifting demographics, and heightened regulatory scrutiny. By aligning its product strategy with evolving lifestyle trends and consumer expectations, the company can transform current challenges into sustainable growth opportunities.