STMicroelectronics NV Releases Semi-Annual Financial Report

STMicroelectronics NV, a leading player in the global semiconductor industry, has unveiled its IFRS 2025 semi-annual accounts, providing a snapshot of the company’s financial performance in the first half of the year. The release of this report comes at a time when the company’s stock price has been experiencing fluctuations, with a recent high and low.

The stock’s market capitalization remains substantial, a testament to the company’s significant presence in the industry. However, the price-to-earnings ratio is relatively high, indicating that investors are placing a premium on the company’s future growth prospects. While there is no direct news related to the company’s financial performance or stock price movements in the provided news snippets, it is likely that the company’s financial reports and stock performance will be influenced by the overall semiconductor industry trends and global economic conditions.

Key Takeaways from the Report

- The company’s semi-annual accounts provide a comprehensive overview of its financial performance in the first half of the year.

- The stock price has experienced fluctuations, with a recent high and low.

- The stock’s market capitalization remains significant, indicating the company’s substantial presence in the industry.

- The price-to-earnings ratio is relatively high, suggesting that investors are optimistic about the company’s future growth prospects.

Industry Trends and Global Economic Conditions

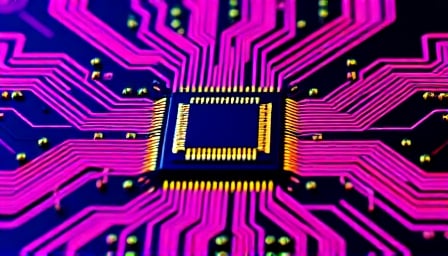

The semiconductor industry is a key driver of technological innovation, and companies like STMicroelectronics NV are at the forefront of this trend. However, the industry is also highly sensitive to global economic conditions, including factors such as trade policies, economic growth, and consumer demand. As a result, the company’s financial performance and stock price are likely to be influenced by these broader trends.

What’s Next for STMicroelectronics NV?

The release of the semi-annual accounts provides a valuable insight into the company’s financial performance and stock price movements. However, the company’s future prospects will depend on a range of factors, including the overall semiconductor industry trends and global economic conditions. As the company continues to navigate these challenges, investors will be closely watching its financial reports and stock performance for signs of growth and stability.