Epiroc’s Bold Moves: A Shot in the Arm for the Swedish Giant

Epiroc AB, the Swedish stalwart of the equipment and services industry, has made two significant announcements in recent days that are sure to send shockwaves through the market. The company’s CEO, Jodie Velasquez, has taken a bold step by buying 2,820 A-shares in the company at a price of $21.20 per share. This move is a clear indication of her confidence in the company’s future prospects, and it’s a message that should not be ignored.

- The CEO’s stock purchase is a vote of confidence in the company’s ability to deliver results. It’s a signal to investors that Epiroc is on the right track, and it’s a move that should be taken seriously.

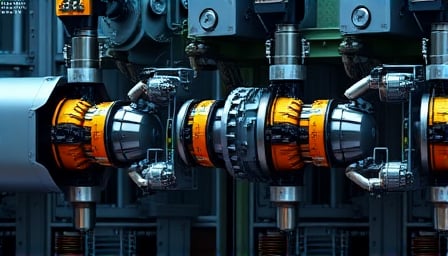

- The company’s commitment to innovation is evident in its decision to break ground on a new production and research and development facility in Nashik, India. This facility will develop and produce equipment for the mining and construction industries, and it’s a move that will help Epiroc stay ahead of the competition.

- The facility is expected to start operations in the third quarter of 2026, and it’s a significant investment in the company’s future. It’s a move that will help Epiroc support its customers in India and globally with high-quality products and solutions.

The company’s stock price has been affected by the recent market fluctuations, but the news of the new facility and the CEO’s stock purchase may have a positive impact on the company’s future performance. It’s a wake-up call for investors who may have been skeptical about Epiroc’s ability to deliver results.

The market is watching Epiroc closely, and the company’s next move will be crucial in determining its future prospects. Will the company continue to make bold moves, or will it play it safe? Only time will tell, but one thing is certain - Epiroc is not going to let the market dictate its future. The company is taking control, and it’s a move that should be applauded.

The question on everyone’s mind is: what’s next for Epiroc? Will the company continue to make significant investments in its future, or will it focus on cost-cutting measures to boost its bottom line? The answer to this question will determine the company’s future prospects, and it’s a question that only time will answer.

One thing is certain, however - Epiroc is not going to let the market dictate its future. The company is taking control, and it’s a move that should be applauded. The CEO’s stock purchase and the new facility are just the beginning, and it’s a sign that Epiroc is ready to take on the challenges of the future.